A long stock collar option strategy, also known simply as a “stock collar,” is an options trading strategy that involves holding a long position in a stock while simultaneously using options to limit both potential losses and gains. It is…

Calendar spreads options, also known as a time spreads or horizontal spreads, are options trading strategies that involve buying and selling options of the same underlying asset, with the same strike price, but with different expiration dates. Calendar spreads profit…

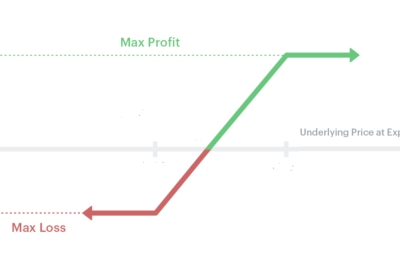

Options vertical spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset, and the same expiration date, but with different strike prices. They are called “vertical” spreads because the different strike prices create…

The diagonal spread is a strategy where you enter into long and short positions simultaneously by buying and selling the same types of options (calls or puts), but with different strike prices and different expiration dates. This options trading strategy…