The Options Wheel Strategy

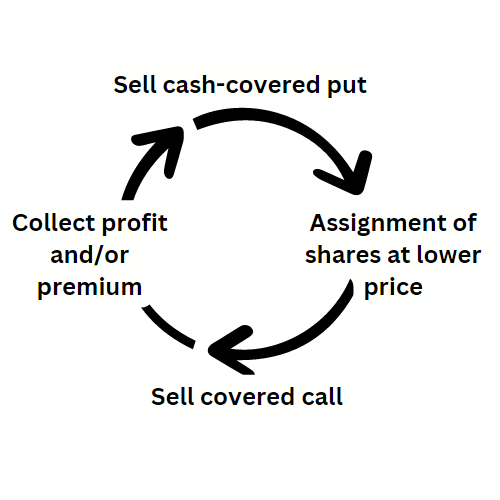

Looking for a low-risk strategy for collecting premiums while selling options? Then the wheel strategy is the one for you. It involves selling cash-secured puts and covered calls in a cyclical manner to generate profit.

So, how does this work?

Lets see the wheel in motion

Sell a Cash-Covered Put

We start the wheel by selling a cash-covered put on a stock we believe to be mildly bullish. Ideally the stock would go up and premium is collected without assignment. However, if it is assigned you will have 100 shares of stock at a pretty good price.

So what do you do when the stock goes up and the Put expires? This is perfect, because you keep the premium from the Put that expires worthless, and you sell a new one collecting the premium again. You can continue repeating this process of selling a cash-secured Put, letting it expire worthless, and then selling another one indefinitely.

Sell Covered-Call

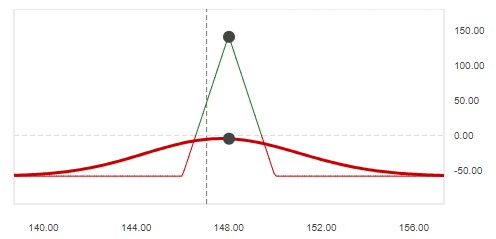

What if the stock price drops, and your Put gets assigned, you now own 100 shares of the stock? So the next step that you do if this happens is to sell a covered Call. Ideally, the strike price for the Call should be above the price the shares got assigned for. This way you can profit from the sale of the stock itself, in addition to the option premium you collect by selling the Call.

If the price never rises above the strike price, your Call will expire worthless. You keep the premium from that option, and sell a new Covered Call collecting a new premium. You can continue repeating this process of selling a Covered Call, letting it expire worthless, and then selling a new one indefinitely.

A Cyclical cycle

As the diagram illustrates, you start the process by selling a cash-covered put. If the stock price goes down you get assigned 100 shares at a lower price. Then you sell a covered call, and if the stock prices goes up you collect the premium while selling the shares for a higher price and make a profit.

Fantastic! You make your premium and a profit! ……And then you repeat this cycle all over again!

When to Pause the Wheel

As mentioned in the beginning, this strategy is great for when you’re mildly bullish on a stock, or even if it’s just going sideways. But what if you think the market has peaked? It’s when you think the stock price has gotten too high that you might want to pause on selling a new Put. This is because if the price falls, you could end up owning the stock at a fairly high price just as it’s entering a downward cycle.

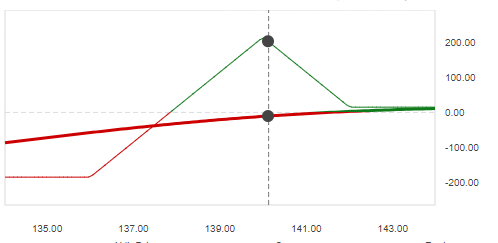

However, you can protect yourself when the stock price starts getting too high by buying a Put at a lower strike price than the one you sold. This creates a spread that prevents you from getting stuck with the stock at too high of a price if it takes a major dive. With a spread, your maximum loss is only the price difference between the Put you sold and the Put you bought.

If the stock price drops too far after the Put assignment, you may want to wait before selling the Call. If you do sell a Call, don’t open it for a strike price so low you lose money on the sale of the stock. However, each call that you sell that expires worthless effectively reduces your cost basis on the stock. So factor that in when setting your next strike price.

Build your cash, sell another Put

As you repeat this cycle over and over, you’re going to build up a nice pile of cash. Once you have enough, you can start a new cycle by selling a cash-secured Put on a different stock, or even on the same stock you’re already trading on. With two options going at any given time you will be doubling the amount of income you’re bringing in!

As you can imagine, at double the pace, it won’t take long before you have enough cash to start a third cycle going. And then a fourth, and a fifth. This is a very low-risk way to scale your options trading while a market is going up or even just going sideways.

Not without Risk

The Wheel Strategy is a great way to establish a passive options income, but it does come with some risk. And the main risk is the stock itself.

This strategy is reliant on trading options on a high-quality, stable stock that isn’t at risk for a big fall. If you choose a risker stock, you must remember that you are going to be in a long stock position once the Put is assigned. If that company gets into trouble, and the stock craters, you could lose big.

As always, choose your stocks wisely, and be patient.

What do you think about this strategy? Have you used the Wheel Strategy before?

Leave a comment below on your experience with the wheel strategy. Also be sure to subscribe so you never miss a blog post!

Everything is very open with a really clear description of the issues. It was definitely informative. Your site is useful. Thank you for sharing!

You have brought up a very wonderful details , regards for the post.

I have been absent for a while, but now I remember why I used to love this website. Thanks, I?¦ll try and check back more frequently. How frequently you update your web site?

I will immediately grab your rss as I can’t find your e-mail subscription link or e-newsletter service. Do you’ve any? Please allow me recognize so that I may just subscribe. Thanks.

Hmm is anyone else encountering problems with the images on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

I love your writing style genuinely loving this web site.

Really excellent information can be found on blog.

I really enjoy studying on this web site, it has got great blog posts.

Pretty section of content. I just stumbled upon your site and in accession capital to assert that I get actually enjoyed account your blog posts. Any way I will be subscribing to your feeds and even I achievement you access consistently rapidly.

[url=https://fastpriligy.top/]priligy 60 mg price[/url] Monitor Closely 1 primidone and papaverine both increase sedation

Hi, i think that i noticed you visited my blog thus i came to “return the choose”.I’m attempting to find issues to improve my site!I assume its good enough to use a few of your concepts!!

I discovered your weblog site on google and test a few of your early posts. Continue to maintain up the excellent operate. I simply extra up your RSS feed to my MSN News Reader. In search of ahead to reading extra from you afterward!…

You are my inspiration , I possess few blogs and often run out from to brand : (.

An impressive share, I simply given this onto a colleague who was doing somewhat analysis on this. And he in truth bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the deal with! However yeah Thnkx for spending the time to debate this, I feel strongly about it and love reading more on this topic. If possible, as you develop into expertise, would you mind updating your weblog with extra details? It’s highly helpful for me. Large thumb up for this weblog put up!

I haven¦t checked in here for a while since I thought it was getting boring, but the last few posts are good quality so I guess I¦ll add you back to my daily bloglist. You deserve it my friend 🙂

Excellent blog! Do you have any recommendations for aspiring writers? I’m hoping to start my own site soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m completely overwhelmed .. Any recommendations? Kudos!

Appreciate it for helping out, excellent info .

I have read some good stuff here. Certainly worth bookmarking for revisiting. I wonder how much effort you put to create such a magnificent informative site.

Great post. I was checking continuously this blog and I am impressed! Extremely helpful information specifically the last part 🙂 I care for such information much. I was looking for this particular information for a long time. Thank you and best of luck.

Thank you for sharing excellent informations. Your site is so cool. I am impressed by the details that you¦ve on this website. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my pal, ROCK! I found just the info I already searched all over the place and just couldn’t come across. What an ideal site.

Very interesting details you have observed, regards for putting up.

An impressive share, I simply given this onto a colleague who was doing a bit of evaluation on this. And he in reality bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to debate this, I really feel strongly about it and love reading extra on this topic. If attainable, as you become experience, would you thoughts updating your weblog with more details? It’s extremely useful for me. Massive thumb up for this weblog put up!

Perfectly pent subject material, regards for selective information.

I visited a lot of website but I believe this one has got something extra in it in it

I likewise think thence, perfectly indited post! .

Pretty! This was a really wonderful post. Thank you for your provided information.

Kantorbola99 menawarkan pengalaman bermain slot online yang menyenangkan. Platform ini menyediakan beragam pilihan game menarik. Pemain dapat menikmati tampilan grafis berkualitas tinggi.

You got a very fantastic website, Gladiola I observed it through yahoo.

I’m curious to find out what blog platform you’re working with? I’m having some minor security issues with my latest blog and I would like to find something more secure. Do you have any solutions?

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

As soon as I found this internet site I went on reddit to share some of the love with them.

Real great information can be found on blog.

I have been absent for a while, but now I remember why I used to love this site. Thank you, I’ll try and check back more frequently. How frequently you update your website?

You have brought up a very great points, regards for the post.

Hi, Neat post. There is a problem with your web site in internet explorer, would test this… IE still is the market leader and a large portion of people will miss your magnificent writing due to this problem.

You could certainly see your skills in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always follow your heart.

I was recommended this website by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my problem. You’re wonderful! Thanks!

I will right away take hold of your rss feed as I can not to find your e-mail subscription hyperlink or newsletter service. Do you’ve any? Kindly let me recognise so that I may just subscribe. Thanks.

I’m really impressed by the speed and responsiveness.

The layout is visually appealing and very functional.

The content is well-organized and highly informative.

The design and usability are top-notch, making everything flow smoothly.

LOTTO CHAMP REVIEWS

The layout is visually appealing and very functional.

Open-world games are the best! Nothing beats the feeling of total freedom, exploring vast landscapes, and creating your own adventure.

Some genuinely excellent content on this web site, appreciate it for contribution. “Such evil deeds could religion prompt.” by Lucretius.

AQUA SCULPT

Im now not certain where you’re getting your information, but good topic. I needs to spend some time finding out much more or understanding more. Thanks for excellent info I used to be on the lookout for this information for my mission.

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.