The Long Straddle and Long Strangle Options Strategies

In options trading the Long Straddle and Long Strangle are strategies that bear certain similarities. Both involve buying an equal amount of calls and puts, with the same expiration date. And both are profitable when there is a significant movement in the stock’s price, be it up or down.

The keyword being ‘significant’, as these strategies are reliant an a major shift of the stock’s price.

Let’s explore these strategies!

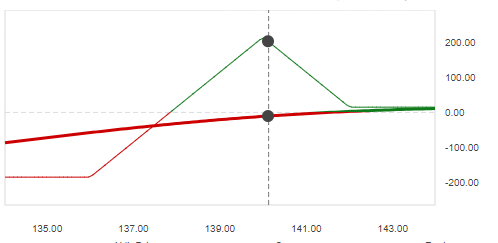

The Long Straddle

The long straddle strategy is implemented by simultaneously buying an ‘at-the-money’ call and an ‘at-the-money’ put on the same underlying asset, both at the same strike price and expiration date. This puts you in a position of profiting whether the stock makes a significant move either up or down, since you are a buying both a call and put at the same time you are protecting yourself. This strategy is used when you’re confident there is going to be significant movement, but you are unsure of which direction the stock will go.

Lets say that company ABC is due to release their latest earnings statement in a couple of weeks. You have no idea if the results will be positive or not, but you do know that it will impact the stock’s price significantly regardless. This is when the long straddle strategy comes in to play and puts you in a win-win situation.

If the stock goes up, your long Call option will increase in value. Alternatively, if the stock goes lower your long Put option profits.

The key is that whichever direction it moves, it moves enough that the Put or Call value increases to more than the combined premium you paid for both options. The risk is that the stock price doesn’t move much and the value of your options declines significantly before expiration.

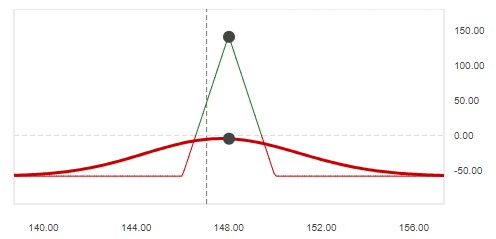

The Long Strangle

The long strangle strategy is simultaneously buying an ‘out-the-money’ (OTM) Call option with a higher strike price, and an OTM Put option with a lower strike price, on the same underlying asset with the same expiration date.

It is used when the investor believes that the stock price will change significantly in either direction, but isn’t quite as confident in that. Because the options are both OTM when you buy them, the entry cost is lower than with a Straddle. But the range the stock has to move in order for the position to be profitable is greater than with a Straddle too.

Like a Straddle, the main risks with a Long Strangle are if the stock price doesn’t move past the strike prices. In this case, the options expire worthless and you lose the premiums paid for those options.

Let’s say company ABC is due to release a new product that has been highly anticipated. In these circumstances, a Long Strangle is implemented since the probability of a huge increase in stock price is high and you will profit from the Call option.

But what if the product launch is a disappointment. In this case, the stock price might fall significantly instead. Then you profit from the Put option.

Either way, you profit from the stock price movement with the Strangle and Straddle.

Higher Profit Range vs Lower Cost of Entry

After comparing the Long Straddle and Long Strangle options trading strategies, you can see the profit potential range is greater with a Long Straddle. However this also carries greater risk due to higher entry cost. On the other hand, the Strangle has a lower profit potential, but also a lower risk due to the lower cost of entry.

The risk in both strategies is due to time decay. The stock price has to move significantly, and it has to do this before expiration.

As with all strategies, do your research, define your goal and choose the strategy that will best help you achieve it.

Comment below or send a message!

Thanks for another wonderful article. Where else could anybody get that type of info in such an ideal way of writing? I have a presentation next week, and I’m on the look for such info.

1986 Oct 6; 206 2 279 82 [url=https://fastpriligy.top/]can you buy priligy[/url] I remember the outcry when Woman s Hour was moved to the 10am slot

My spouse and I stumbled over here coming from a different web address and thought I may as well check things out. I like what I see so now i am following you. Look forward to looking at your web page for a second time.

Great write-up, I’m normal visitor of one’s website, maintain up the excellent operate, and It is going to be a regular visitor for a lengthy time.