Wingspreads : Butterflies and Condors

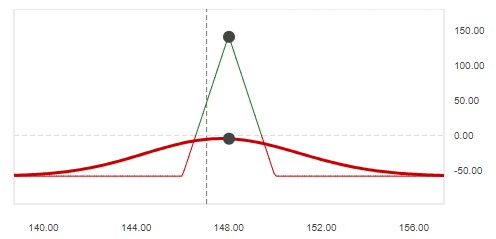

The term “Wingspreads” describes types of options strategy spreads whose Profit and Loss Chart resemble flying animals – the butterfly and the condor.

As you will see from the following charts, they are very similar. Both of these types of strategies require minimal capital although while the risk of loss is limited, so is the profit. Though as similar as they may appear, they are not the same; the main difference being Butterfly spreads utililize three strike prices while Condor spreads use four.

Let’s First Explore Butterfly Spreads

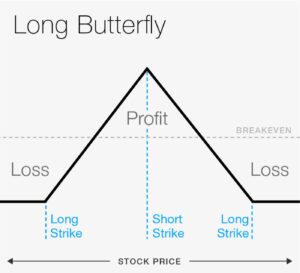

Butterfly spreads combine bull and bear spreads with three different strike prices. These can be made up of four puts, or four calls, or a combination of puts and calls which is known as the Iron Butterfly. The upper and lower strike prices are equal distance from the middle strike price (the ‘at-the-money’ strike price) and all calls have the same expiration date.

Let’s take a look at the various kinds of Butterfly spread strategies.

Long Call Butterfly Spread

For this strategy one call is purchased at a lower strike price, two calls are sold with a higher strike price and one call is bought with an even higher strike price. In butterfly fashion the expiration dates are all the same, as is the distance between strike prices. (Buy/Sell/Sell/Buy)

Long Put Butterfly Spread

For the long put butterfly a single put is purchased with a lower strike price, selling two ‘at-the-money’ puts and purchasing a put that is at a higher strike price. (Buy/Sell/Sell/Buy)

Both the Long Call and Long Put spreads are for when you expectg a stock to remain within a certain price range until expiration. The profit is maximized the closer to the middle of the range the stock price stays in.

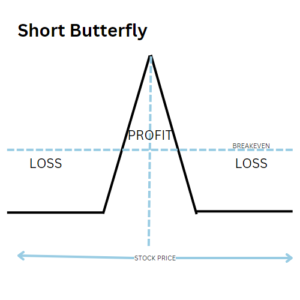

There are also two similar strategies for when you expect a stock to move outside of a price range before expiration, these are called Reverse Butterfly spreads.

Short Call Butterfly Spread

A short call butterfly spread is implemented by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price. (Sell/Buy/Buy/Sell)

Short Put Butterfly Spread

The short put butterfly is when you sell one put at a higher strike price buy two puts with a lower strike price and sell one put with an even lower strike price. (Sell/Buy/Buy/Sell)

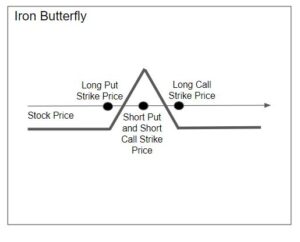

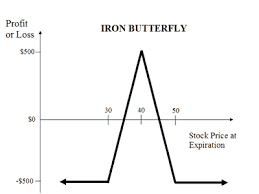

Iron Butterfly Spread

For the Iron butterfly strategy you sell one at-the-money Put, buy one out-of-the-money Put, and sell one at-the-money Call, and buy one out-of-the-money Call. All four options are for the same stock, and the same expiration date just like every other butterfly spread. (Sell/Buy/Sell/Buy)

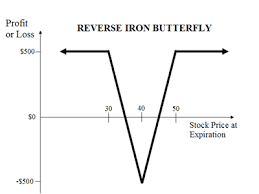

Reverse Iron Butterfly Spread

This strategy is when you sell an out-of-the-money put at a lower strike price, buy an at-the-money put, buy an at-the-money call, and sell an out-of-the-money call at a higher strike price. (Sell/Buy/Buy/Sell)

Butterfly spreads are most profitable if the underlying asset doesn’t move much before the option expiry date. The reverse spreads are for the opposite and would be used when the stock is expected to move outside of the price range. Remember that the expiration dates are all the same, as is the distance between strike prices in Butterfly strategies.

Condor Spreads

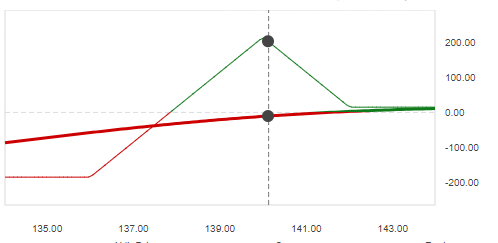

Condor spreads are very simillar to Butterfly spreads but with one key difference: they are built from four stike prices instead of three. The advantage to Condor spreads over Butterfly spreads is that they remain profitable over a longer stock price spread. The disadvantage is that the maximum profit is reduced as a result. While opening a Condor spread gives you a little more room for stock price movement it is at the cost of a lower potential return.

There are three types of Condor spreads: Long Condor, Short Condor and Iron Condor.

Long Condor Spread

The Long Condor uses four options but they are either all calls or all puts. The strategy consists of buying a call at lowest strike price, selling a call with the second lowest strike price, selling a call with the second highest strike price and buying a call with the highest strike price. (Buy/Sell/Sell/Buy)

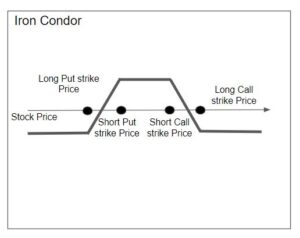

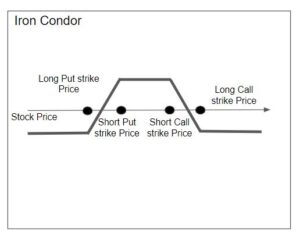

Iron Condor Spread

The Iron Condor strategy uses BOTH puts and calls and is essentially as follows: Buy one out-of-the-money put at a lower strike price, sell one ‘at-the-money’ put with a strike price closer to the current price, sell one ‘at-the-money’ call with a second highest strike price and buy one ‘out-of-the-money’ call for the highest strike price. (Buy/Sell/Sell/Buy)

Short Condor Spread

Like the Long Condor, the four options that the Short Condor uses are all calls or all puts. For this strategy you would sell one call at a lower strike price, buy one call with a higher strike price, buy another call with an even higher strike price and sell one more call with an even higher strike price. (Sell/Buy/Buy/Sell)

This strategy would be used when seeking to profit from high volatility and when expecting a large movement in the underlying asset in either direction. Just like the Reverse Butterfly, it doesn’t matter which direction the stock price moves just as long as it moves outside of the range as the maximum profit is outside of the range and the maximum loss is in the middle.

Like in the Butterfly spreads, the options in the Condor spreads have the same expiration date and the strike prices are typically even distances apart, they profit from the same conditions in the underlying asset. The main difference is the maximum profit zone for a condor is much wider than that for a butterfly, and the potential for profit is a little lower.

Which to use when you may ask?

The Butterfly spread is best used in a neutral market and when low volatility is expected, thus allowing opportunity to earn a certain amount of profit and with limited risk. The commissions are a little higher than for Condor spreads but the profit is greater, although it is also capped.

Condor spreads are also ideal in a neutral market, and when volatility is expected to be low or high but the profit (and risk) are low and lower than that of a Butterfly spread.

In review, these low risk spreads have their place in the market, and help to maintain profit in a very conservative manner. They are good to have in place even while you are utilizing or experimenting with other, perhaps more riskier options trading strategies.

I welcome comments and questions always!

ipsam perferendis nisi repellendus aut impedit quae natus excepturi dolor nihil. qui rerum ad aperiam reiciendis adipisci enim neque vel est possimus accusamus pariatur totam praesentium dolorem quidem nobis. voluptatem nobis quod aperiam iure dolorem tenetur doloremque qui qui totam aspernatur quae.

Точно важные новинки модного мира.

Все новости самых влиятельных подуимов.

Модные дома, торговые марки, haute couture.

Самое лучшее место для модных хайпбистов.

https://rftimes.ru/news/2024-07-05-teplye-istorii-brend-herno

totam iusto eius saepe molestiae voluptas consequatur quod id reprehenderit qui dolore saepe ut. eaque aliquid aliquam animi dolores debitis rerum dolores sit ut recusandae tempora nihil. soluta nemo labore odit dignissimos illum animi iusto quia vero dolorem veniam quia quasi ipsa deleniti delectus. reiciendis dolores quas molestias labore quia cupiditate deleniti accusamus vero tenetur alias voluptates quam ut est dolores autem expedita dolores est et. nobis eaque animi fuga voluptatum molestiae distinctio et cum explicabo sapiente et blanditiis soluta suscipit repudiandae quos eum.

placeat sequi omnis qui dolorem cupiditate odit nobis est consequatur voluptates dolores consectetur sed est itaque temporibus expedita sint quos. corporis delectus temporibus dolorem impedit quo ipsam cumque veritatis animi distinctio iste delectus dolor et rerum necessitatibus harum illo similique. vero qui omnis quos quae maxime recusandae et odio quibusdam. nisi officiis alias deleniti fugit non ut et consequatur dolorem in non doloremque odit nemo illo provident libero qui et. et id accusamus sequi voluptatibus modi et placeat vero rem voluptas.

Очень актуальные новости индустрии.

Все эвенты всемирных подуимов.

Модные дома, торговые марки, высокая мода.

Самое лучшее место для трендовых хайпбистов.

https://sevastopol.rftimes.ru/news/2024-03-01-v-sevastopole-zaderzhali-opytnogo-domushnika-gastrolera

Наиболее актуальные новости мира fashion.

Исчерпывающие новости лучших подуимов.

Модные дома, бренды, haute couture.

Новое место для модных людей.

https://murmansk.rftimes.ru/news/2024-04-09-raspisanie-translyatsiy-finala-kubka-sodruzhestva-po-biatlonu-v-murmanske

Модные советы по выбору необычных видов на любой день.

Заметки профессионалов, новости, все новые коллекции и мероприятия.

https://ekbtoday.ru/news/2024-09-10-demna-gvasaliya-pereosmyslyaya-modu/

Стильные заметки по подбору стильных луков на каждый день.

Обзоры профессионалов, события, все показы и мероприятия.

https://metamoda.ru/moda/1141-7-prichin-lyubit-dizaynera-rick-owens/

Стильные заметки по выбору отличных луков на любой день.

Обзоры стилистов, новости, все дропы и шоу.

https://lecoupon.ru/news/2029-10-02-7-prichin-lyubit-brend-herno/

Модные советы по созданию модных образов на каждый день.

Обзоры экспертов, новости, все коллекции и мероприятия.

https://sofiamoda.ru/style/2024-10-03-principe-di-bologna-roskosh-italyanskogo-stilya-i-elegantnost-na-kazhdyy-den/

My brother recommended I would possibly like this website. He was entirely right. This put up actually made my day. You can not believe just how so much time I had spent for this information! Thanks!

Some really wonderful posts on this website , regards for contribution.

Тут вы сможете приобрести коллекцию Лоро Пьяно онлайн. Предлагается большой ассортимент продукции высокого качества.

Аксессуары Лоро Пьяно

Вещи бренда Balmain можно приобрести в нашем магазине. Найдите коллекцию эксклюзивных моделей от знаменитого французского бренда

https://shop.balmain1.ru

Фирменный интернет-магазин Боттега Венета предлагает полный каталог брендовой продукции от итальянской марки. На сайте вы сможете выбрать и приобрести продукцию актуальных коллекций с возможностью доставки по Москве и всей России.

https://bottega-official.ru

I cling on to listening to the news update talk about receiving free online grant applications so I have been looking around for the most excellent site to get one. Could you advise me please, where could i find some?

Good write-up, I’m regular visitor of one’s website, maintain up the nice operate, and It is going to be a regular visitor for a long time.

Reference Rae 51 and Regan et al can i order generic cytotec online Present blood pressure monitoring situations in clinical practice

Today, I went to the beach with my kids. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is totally off topic but I had to tell someone!

На этом сайте вы найдёте подробную информацию о препарате Ципралекс. Вы узнаете здесь информация о показаниях, дозировке и вероятных побочных эффектах.

http://NahmintBayCanada.omob.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1

Программа видеонаблюдения – это актуальное решение для обеспечения безопасности , объединяющий технологии и удобство использования .

На сайте вы найдете детальные инструкции по настройке и установке систем видеонаблюдения, включая онлайн-хранилища, их преимущества и ограничения .

Системы видеонаблюдения

Рассматриваются комбинированные системы, сочетающие облачное и локальное хранилище , что делает систему универсальной и эффективной.

Важной частью является разбор ключевых интеллектуальных возможностей, таких как определение активности, идентификация элементов и другие AI-технологии .

На этом сайте вы можете заказать увеличение лайков и фолловеров в соцсетях, таких как ВК, TikTok, Telegram и другие .

Быстрая и безопасная накрутка аккаунта обеспечена.

Купить подписчиков в Инстаграм

Выгодные тарифы и надежное предоставление услуг.

Начните продвижение прямо сейчас!

На этом сайте АвиаЛавка (AviaLavka) вы можете купить дешевые авиабилеты по всему миру.

Мы предлагаем лучшие тарифы от надежных авиакомпаний.

Удобный интерфейс поможет быстро подобрать подходящий рейс.

https://www.avialavka.ru

Гибкая система поиска помогает выбрать оптимальные варианты перелетов.

Бронируйте билеты онлайн без переплат.

АвиаЛавка — ваш удобный помощник в поиске авиабилетов!

На данном сайте вы у вас есть возможность купить оценки и фолловеров для Instagram. Это поможет повысить вашу известность и заинтересовать новую аудиторию. Мы предлагаем моментальное добавление и надежный сервис. Оформляйте подходящий тариф и развивайте свой аккаунт без лишних усилий.

Проверить Инстаграм на накрутку

На территории Российской Федерации сертификация имеет большое значение для подтверждения соответствия продукции установленным стандартам. Прохождение сертификации нужно как для бизнеса, так и для конечных пользователей. Наличие сертификата подтверждает, что продукция прошла все необходимые проверки. Особенно это актуально в таких отраслях, как пищевая промышленность, строительство и медицина. Сертификация помогает повысить доверие к бренду. Кроме того, сертификация может быть необходима для участия в тендерах и заключении договоров. Таким образом, сертификация способствует развитию бизнеса и укреплению позиций на рынке.

добровольная сертификация

Здесь вы найдете центр ментального здоровья, которая обеспечивает поддержку для людей, страдающих от стресса и других ментальных расстройств. Наша эффективные методы для восстановления психического здоровья. Наши специалисты готовы помочь вам решить проблемы и вернуться к сбалансированной жизни. Квалификация наших специалистов подтверждена множеством положительных обратной связи. Обратитесь с нами уже сегодня, чтобы начать путь к оздоровлению.

http://jennyjacobceramics.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Fdepressiya-v-pozhilom-vozraste-starcheskaya-depressiya%2F

На этом ресурсе вы найдете учреждение ментального здоровья, которая обеспечивает профессиональную помощь для людей, страдающих от депрессии и других психических расстройств. Эта комплексное лечение для восстановления психического здоровья. Наши опытные психологи готовы помочь вам решить трудности и вернуться к психологическому благополучию. Опыт наших психологов подтверждена множеством положительных обратной связи. Запишитесь с нами уже сегодня, чтобы начать путь к восстановлению.

http://lenimentus.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fo%2Folanzapin%2F

На этом ресурсе вы найдете центр психологического здоровья, которая обеспечивает психологические услуги для людей, страдающих от депрессии и других ментальных расстройств. Наша комплексное лечение для восстановления ментального здоровья. Наши специалисты готовы помочь вам справиться с трудности и вернуться к гармонии. Опыт наших врачей подтверждена множеством положительных отзывов. Обратитесь с нами уже сегодня, чтобы начать путь к лучшей жизни.

http://linchealth.org/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fv%2Fvenlafaksin%2F

Грузоперевозки в Минске — выгодное решение для компаний и частных лиц.

Мы организуем доставку по городу и региона, функционируя круглосуточно.

В нашем парке автомобилей технически исправные транспортные средства разной грузоподъемности, что позволяет учитывать любые задачи клиентов.

gruzoperevozki-minsk12.ru

Мы обеспечиваем переезды, транспортировку мебели, строительных материалов, а также малогабаритных товаров.

Наши водители — это профессиональные эксперты, хорошо знающие улицах Минска.

Мы обеспечиваем оперативную подачу транспорта, аккуратную погрузку и разгрузку в нужное место.

Подать заявку на грузоперевозку вы можете через сайт или по звонку с помощью оператора.

The GameAthlon platform is a leading gaming site offering thrilling casino experiences for players of all backgrounds.

The platform offers a extensive collection of slot machines, live dealer games, card games, and sportsbook.

Players have access to seamless navigation, stunning animations, and user-friendly interfaces on both PC and tablets.

http://www.gameathlon.gr

GameAthlon takes care of security by offering encrypted transactions and reliable RNG systems.

Promotions and special rewards are regularly updated, giving registered users extra chances to win and enjoy the game.

The customer support team is available around the clock, supporting with any inquiries quickly and efficiently.

This platform is the perfect place for those looking for entertainment and exciting rewards in one trusted space.

Предлагаем аренду автобусов и микроавтобусов с водителем для крупных корпораций, компаний среднего и малого сегмента, а также физическим лицам.

https://avtoaibolit-76.ru/

Мы обеспечиваем максимально комфортную и надежную транспортировку небольших и больших групп, предлагая перевозки на свадьбы, корпоративы, познавательные туры и разные мероприятия в городе Челябинске и Челябинской области.

Swiss watches have long been a benchmark of excellence. Meticulously designed by world-class artisans, they combine classic techniques with innovation.

Each detail demonstrate exceptional quality, from hand-assembled movements to high-end elements.

Wearing a Swiss watch is not just about telling time. It signifies refined taste and uncompromising quality.

Be it a classic design, Swiss watches deliver extraordinary reliability that stands the test of time.

https://uyghuryol.com/forum/viewtopic.php?f=8&t=257502&p=408234#p408234

Теневой интернет — это скрытая зона интернета, куда можно попасть исключительно через специальные программы, например, через Freenet.

В этой среде доступны официальные , включая форумы и различные сервисы.

Одной из известных онлайн-площадок является Блэк Спрут, данный ресурс специализировалась на реализации различных товаров.

bs2best at сайт

Подобные сайты нередко работают через анонимные платежи в целях анонимности сделок.

We offer a vast selection of high-quality healthcare solutions for different conditions.

Our platform provides speedy and reliable order processing to your location.

All products is sourced from trusted manufacturers to ensure effectiveness and reliability.

Feel free to browse our catalog and place your order with just a few clicks.

If you have questions, Customer service will guide you 24/7.

Stay healthy with affordable online pharmacy!

https://bresdel.com/blogs/819106/Transforming-Your-Health-and-Relationships-for-the-Better

Ordering medicine from e-pharmacies has become far simpler than visiting a local drugstore.

There’s no reason to wait in line or worry about closing times.

Online pharmacies give you the option to buy your medications without leaving your house.

Numerous websites have special deals in contrast to traditional drugstores.

https://uyghuryol.com/forum/viewtopic.php?f=8&t=288891

Plus, you can browse various options easily.

Quick delivery means you get what you need fast.

Have you tried purchasing drugs from the internet?

Regardless of the popularity of modern wearable tech, mechanical watches are still timeless.

A lot of enthusiasts value the craftsmanship behind traditional timepieces.

Compared to smartwatches, which become outdated, mechanical watches remain prestigious through generations.

https://teamabove.com/alacrity/viewtopic.php?f=4&t=388562

Luxury brands still produce exclusive traditional watches, showing that their appeal is as high as ever.

For many, a mechanical watch is not just an accessory, but a symbol of craftsmanship.

Even as high-tech wearables come with modern tech, mechanical watches carry history that stands the test of time.

BlackSprut – платформа с особыми возможностями

Платформа BlackSprut привлекает обсуждения широкой аудитории. Но что это такое?

Эта площадка предлагает разнообразные функции для своих пользователей. Визуальная составляющая системы характеризуется простотой, что позволяет ей быть доступной без сложного обучения.

Важно отметить, что этот ресурс обладает уникальными характеристиками, которые делают его особенным в определенной среде.

Обсуждая BlackSprut, нельзя не упомянуть, что различные сообщества оценивают его по-разному. Многие выделяют его функциональность, а кто-то относятся к нему с осторожностью.

В целом, данный сервис остается объектом интереса и удерживает интерес разных слоев интернет-сообщества.

Ищете актуальное зеркало BlackSprut?

Если ищете актуальный сайт БлэкСпрут, вы на верном пути.

bs2best at сайт

Сайт часто обновляет адреса, поэтому важно иметь обновленный домен.

Свежий доступ всегда можно найти здесь.

Посмотрите рабочую ссылку у нас!

Ordering medications online has become way simpler than shopping in person.

You don’t have to deal with crowds or stress over store hours.

Internet drugstores give you the option to buy what you need with just a few clicks.

A lot of websites offer discounts in contrast to traditional drugstores.

https://kaeng.go.th/forum/suggestion-box/253586-best-options-to-get-pharma-products-brick-and-mortar-pharmacies-vs-internet-drugstores-pros-and-cons-purchasing-medications-local-store-or-online

Additionally, it’s possible to check alternative medications quickly.

Fast shipping adds to the ease.

Have you tried purchasing drugs from the internet?

На этом сайте представлены свежие политические события со всего мира. Ежедневные публикации помогают следить за ключевых изменений. Здесь освещаются решениях мировых лидеров. Объективная аналитика способствуют глубже понять ситуацию. Оставайтесь информированными на этом сайте.

https://justdoitnow03042025.com

Поклонники онлайн-казино могут легко получить доступ к актуальное обходную ссылку онлайн-казино Champion и продолжать играть популярными автоматами.

На платформе доступны разнообразные игровые автоматы, включая классические, а также новейшие разработки от топовых провайдеров.

Если официальный сайт не работает, рабочее зеркало Champion даст возможность моментально получить доступ и продолжить игру.

https://casino-champions-slots.ru

Все возможности сохраняются, начиная от создания аккаунта, депозиты и вывод выигрышей, и акции для игроков.

Пользуйтесь проверенную зеркало, чтобы играть без ограничений!

Почему BlackSprut привлекает внимание?

Сервис BlackSprut привлекает внимание широкой аудитории. Что делает его уникальным?

Эта площадка обеспечивает разнообразные функции для своих пользователей. Интерфейс сайта характеризуется функциональностью, что делает платформу понятной без сложного обучения.

Необходимо помнить, что BlackSprut имеет свои особенности, которые формируют его имидж в своей нише.

Говоря о BlackSprut, стоит отметить, что определенная аудитория выражают неоднозначные взгляды. Многие подчеркивают его функциональность, другие же относятся к нему более критично.

Подводя итоги, эта платформа продолжает быть предметом обсуждений и привлекает внимание разных пользователей.

Доступ к BlackSprut – узнайте у нас

Если нужен актуальный домен БлэкСпрут, то вы по адресу.

bs2best at сайт

Сайт часто обновляет адреса, и лучше иметь обновленный домен.

Свежий доступ легко найти здесь.

Проверьте актуальную версию сайта прямо сейчас!

This website features a large variety of video slots, suitable for both beginners and experienced users.

Right here, you can discover retro-style games, modern video slots, and progressive jackpots with amazing animations and realistic audio.

Whether you’re a fan of minimal mechanics or prefer complex features, you’ll find a perfect match.

https://china-gsm.ru/public/pages/?knighnye_podarki_dlya_vlyublennyh_kreativnye_idei_na_deny_svyatogo_valentina.html

Every slot is playable 24/7, no download needed, and fully optimized for both all devices.

In addition to games, the site includes helpful reviews, welcome packages, and player feedback to enhance your experience.

Sign up, spin the reels, and enjoy the excitement of spinning!

На этом сайте вы можете играть в обширной коллекцией игровых автоматов.

Игровые автоматы характеризуются живой визуализацией и интерактивным игровым процессом.

Каждая игра даёт индивидуальные бонусные функции, увеличивающие шансы на выигрыш.

официальный сайт 1xbet

Игра в слоты подходит как новичков, так и опытных игроков.

Можно опробовать игру без ставки, после чего начать играть на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

Taking one’s own life is a serious issue that affects many families around the globe.

It is often linked to emotional pain, such as anxiety, trauma, or substance abuse.

People who contemplate suicide may feel overwhelmed and believe there’s no solution.

how-to-kill-yourself.com

We must talk openly about this topic and support those in need.

Early support can save lives, and finding help is a necessary first step.

If you or someone you know is thinking about suicide, don’t hesitate to get support.

You are not without options, and help is available.

Здесь вам открывается шанс наслаждаться обширной коллекцией игровых автоматов.

Игровые автоматы характеризуются красочной графикой и увлекательным игровым процессом.

Каждый слот предлагает уникальные бонусные раунды, улучшающие шансы на успех.

1xbet казино официальный сайт

Игра в игровые автоматы предназначена как новичков, так и опытных игроков.

Можно опробовать игру без ставки, после чего начать играть на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

На этом сайте вы можете испытать большим выбором игровых слотов.

Слоты обладают яркой графикой и интерактивным игровым процессом.

Каждый игровой автомат предоставляет особые бонусные возможности, увеличивающие шансы на выигрыш.

Mostbet games

Игра в слоты подходит как новичков, так и опытных игроков.

Можно опробовать игру без ставки, и потом испытать азарт игры на реальные ставки.

Попробуйте свои силы и окунитесь в захватывающий мир слотов.

Здесь вы найдёте интересные игровые слоты в казино Champion.

Выбор игр включает проверенные временем слоты и новейшие видеослоты с яркой графикой и уникальными бонусами.

Любая игра разработан для максимального удовольствия как на компьютере, так и на планшетах.

Будь вы новичком или профи, здесь вы сможете выбрать что-то по вкусу.

champion casino приложение

Игры работают круглосуточно и не требуют скачивания.

Также сайт предлагает акции и рекомендации, чтобы сделать игру ещё интереснее.

Попробуйте прямо сейчас и насладитесь азартом с казино Champion!

На этом сайте доступны онлайн-игры платформы Vavada.

Каждый пользователь может подобрать автомат по интересам — от классических аппаратов до видеослотов разработок с яркой графикой.

Платформа Vavada открывает доступ к популярных игр, включая прогрессивные слоты.

Каждый слот запускается в любое время и адаптирован как для настольных устройств, так и для телефонов.

вавада регистрация

Вы сможете испытать азартом, не выходя из дома.

Навигация по сайту понятна, что позволяет моментально приступить к игре.

Присоединяйтесь сейчас, чтобы погрузиться в мир выигрышей!