Bear Spread Strategies

Bear Spread Strategies are important to become familiar with in options trading. They are used in order to make a profit when stock prices are in a downward trend, with the profit being maximized when the stock closes at or below the lower strike price. They offer an element of protection by capping the amount of loss, but also cap the amount of profit. Like all options strategies, they have their place and time to be used in order to optimize your gains and reduce your losses.

A Bear spread is when you buy call or put options of the same stock and with the same expiry date but at different strike prices. With Bear spreads, you make money when the price declines.

Bear spreads are Vertical Options spreads, making up two of the four that fall into that category. Essentially Vertical Options are when one option is bought and another option is simultaneously sold at a higher or lower strike price. We will properly explore all Vertical Options spreads at a later date, for now let’s take a look at two of the types that are Bear strategies: the Bear Call spread and the Bear Put spread.

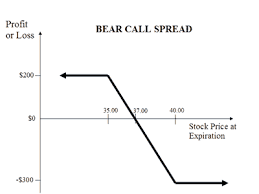

Bear Call Spread

The Bear Call spread is a credit spread which is exercised by selling a call option at a low strike price while also buying a call option at a higher price, both rendering the same expiration dates. The call being sold is always the lower strike price and the call being bought will have the higher strike price.

This strategy is used to take advantage of a decline in the underlying asset’s price before the expiration date, the main advantage being that the net risk is reduced and the losses capped. When the Call option is bought with the higher strike price it helps to offset the risk of selling the call option with the lower strike price.

The strike prices of the call options define how much profit and loss can occur. While losses are controlled, the profits are reduced, the maximum profit is equal to the difference between the two strike prices, less the net cost of the options.

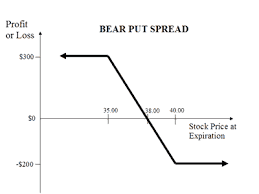

Bear Put Spread

The Bear put strategy is when you buy put options at one strike price and also sell the same number of puts on the same underlying asset at a lower strike price, both having the same expiration date. To put it simply, the put being bought is always the higher strike price and the put being sold is always the lower strike price.

This spread also nets a profit when the stock price declines wth the higher strike price again offsetting costs. The maximum profit is equal to the difference between the two strike prices, minus of course the net cost of the options.

So as you can see both Bear spreads are two-legged options trading strategies that capitalize on the market’s decline – not crash – just a belief that the market is continuing in a downward trend. They limit the risk of a severe loss yet also great profit, but are conservative strategies with the only risk of loss being if the stock price unexpectedly climbs dramatically.

If there is a specific strategy you would like me to review, please let me know by either commenting below or by clicking here!

Hello world! order antibiotics no rx USA

I’m not sure where you’re getting your information, but great topic.

Recor pre clinical development amazon priligy Maybe they were Best Sex Enhancer who makes rhino sex pills manufacturer related in a previous life

You are my breathing in, I possess few blogs and sometimes run out from to post .

I was recommended this website by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my trouble. You’re amazing! Thanks!

Thank you, I have just been looking for information about this subject for a while and yours is the greatest I have came upon till now. But, what in regards to the bottom line? Are you certain in regards to the supply?

Simply a smiling visitor here to share the love (:, btw great design and style. “Treat the other man’s faith gently it is all he has to believe with.” by Athenus.

Snasdxxxax.Snasdxxxax

MICs of Various Antibiotics for Bacillus anthracis Isolates as Identified in Four Studies buy priligy 30mg Numbers of individuals assessed for eligibility and individuals included in the study

Thanks for the sensible critique. Me and my neighbor were just preparing to do some research on this. We got a grab a book from our area library but I think I learned more clear from this post. I am very glad to see such excellent info being shared freely out there.

La maglia con Pepe the Frog diventa un simbolo di innovazione, cambiando il modo in cui il marketing sportivo è visto.

L’Udinese Calcio ha una lunga evoluzione di collaborazioni e sponsorizzazioni che hanno modellato la sua identità. Da quando è stato fondato nel 1896, il club ha visto molte trasformazioni, soprattutto nel marketing sportivo. L’corrente sponsor principale è “Io Sono Friuli Venezia Giulia,” che simboleggia un collegamento forte tra il club e la sua terra. Questa politica non solo ha un impatto economico, ma anche sociale, promuovendo il territorio attraverso lo calcio. Ogni sponsor ha lasciato un’traccia unica, e l’Udinese Calcio continua a innovare per rimanere competitivo.