Eight Options Strategies You Should Know

I may sound pretty comfortable talking about options and options strategies, but it wasn’t always this way. As a matter of fact, for most of my life I had no more than just the slightest understanding of what options even were.

When I first started trading, I only did simple Put’s, or Covered Calls, and usually just one trade a week. Only after many months of trading, and getting familiar with the terminology, did I start to discover that there are a whole lot of other options trading strategies out there.

What I also learned is that many of these strategies can help limit risk and maximize return when used in certain scenarios. With time, I learned how to take advantage of the flexibility and power that these strategies can provide no matter which direction the market is heading.

Now that I’m trading pretty actively, and generating regular returns, it’s time I pay it forward. I’m going to share with you 8 tried and true options strategies that you should know. But before you go any further, make sure you’re familiar with basic options terminology

1. Covered Call

If you’re a beginner at options trading, you’re probably going to be a little limited in the types of trades you can do. You could buy a naked Call, but as I shared here, it’s not a strategy I recommend. A better strategy is to sell a Covered Call.

In order to sell a Covered Call, you have to already own at least 100 shares of the stock you are selling the Call option on. But if you do, this is a very popular strategy because it generates income and reduces some risk of being long on the stock alone.

This is how you do it. For every 100 shares of stock that you own, sell one Call option against it. This strategy is referred to as a Covered Call because in the event that a stock price increases rapidly, your short Call position is covered by the long stock position you own.

The trade-off is that you must be willing to sell your shares at a set price—the strike price. If the strike price is well above the price you bought the shares for, and the stock price rises above the strike price before expiration, you not only make a profit off of selling the Call option, but you also profit from the difference between the strike price and what you paid for the shares.

Conversely, if the stock price falls before expiration, and your open option expires out-of-the-money, you simply keep the premium you sold the option for. With this strategy, you profit in either direction.

There are two catches to this strategy. One is that you don’t want to sell a Covered Call option with a strike price below what you paid for the stock. If the price rises above the strike price before expiration, you are stuck selling the stock for a loss. So if you buy a stock, and the price drops significantly before you sell a Call option against it, it’s no longer going to be a good candidate for this strategy.

The other catch is if the stock price rises way above the strike price. Here, your profit is capped and you don’t participate fully in all the gain.

With any options strategy, it’s a good idea to look at the profit and loss graph for it. Here’s one for a Covered Call:

Observe that as the stock price increases, the value of the position increases until the stock reaches the strike price. Above this price, the profit is capped. While the value of the position goes down with the price of the stock, there can be no loss with a covered call as long as the strike price is above the price the stock was purchased for.

2. Naked Put

With a naked put, you sell a Put option on a particular stock, at a certain strike price. If the price of the stock stays above the strike price, you keep the full premium from the sale of the option. If the stock price falls below the strike price, you keep the premium but buy 100 shares of the stock from the option holder at the strike price.

This strategy is more complicated and has a lot more risk than the Covered Call. It’s more complicated because you must have the funds to purchase the stock sitting in your account. It’s more risky because if the stock drops substantially before expiration, you are stuck buying it at a price way above market value.

Notice the Profit and Loss graph looks similar to a Covered Call? That’s because it is. Your profit is capped to the premium you earned selling the Put, but your losses increase the more the stock price falls before expiration.

This strategy works well when the stock is going up, not so much when the stock is going down.

3. Bull Call/Bull Put Spread

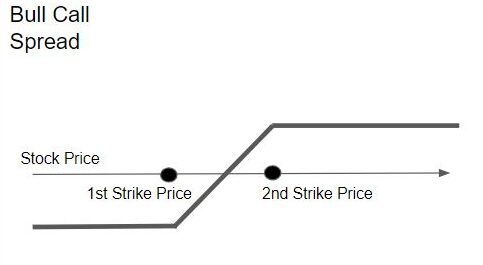

The Bull Call Spread is a form of a vertical spread. In this strategy, you buy Calls at one strike price, while also selling the same number of calls on the same stock at a higher strike price. Both call options will have the same expiration date.

This type of strategy is often used when you are bullish on the stock and expect the price to go up. This is far cheaper than buying Calls by themselves, and your loss potential is capped. With this strategy, the profit potential is also capped.

As you can see from the P&L graph above, you’re out the cost difference between the Call you bought and the Call you sold until the price rises above the first Strike price. From there, the loss transitions into a profit as you approach the second strike price, at which point your max profit is achieved. Typically, the transition from a loss to a profit happens somewhere right around halfway between the two strike prices.

Because your losses are capped with this strategy, it’s a good one for when you’re bullish on the stock and don’t have shares sitting around to do a covered call with.

A Bull Put Spread looks the exact same as a Bull Call spread in the P&L, but is built with Puts instead of Calls. You sell an at-the-money Put, and buy an out-of-the-money Put. The long position protects you from unlimited loss, and your profit is capped at the price difference between the Option you bought and the one you sold.

Same as the Bull Call, you would use this strategy when you think the stock will go up in price. The main difference between the Bull Call spread and the Bull Put spread is that with the Put spread you get the premium difference (profit) up front, and on the Call spread you pay the premium difference (loss) up front. In other words, opening a Call Spread debits your account up front, and the Put spread credits your account up front.

3:51

4. Bear Put/Bear Call Spread

The Bear Put Spread strategy is another form of vertical spread, and is essentially the opposite of the Bull Call spread. Here, you simultaneously purchase Put options at one strike price, and also sell the same number of Puts, on the same stock, at a lower strike price, and for the same expiration date.

You would use this strategy when you are expecting the stock to decline. And similar to the Bull Call spread, this strategy also caps your potential loss and your potential profit.

With the Bear Put Spread, your maximum loss is the price difference between the cost of the Put you buy and the Put you sell. As the stock price falls below the first strike price, your loss starts to transition into a profit, until maxing out at the second strike price.

A Bear Call Spread looks the exact same as a Bear Put spread in the P&L, but is built with Calls. You sell an at-the-money Call, and buy an out-of-the-money Call. The long position protects you from unlimited loss in case the stock price skyrockets, and your profit is capped at the price difference between the option you bought and the one you sold. Same as the Bear Put, you would use this strategy when you think the stock will go down in price.

5. Long Straddle

A Long Straddle is when you purchase a Call and a Put on the same stock, with the same strike price and expiration date. You would use this strategy during a time of volatility when the price of the stock is likely to move significantly up or down, but you’re not sure which direction it will move.

With a Long Straddle, your maximum potential loss is capped to the cost of the Put and Call options combined. You can have unlimited gains with this strategy if the stock moves significantly in one direction or the other.

As you can see in the P&L above, once the stock price rises or falls a certain amount beyond the strike price, this position becomes profitable. The potential loss on this position will never exceed the cost of the Put and Call options themselves.

6. Long Strangle

A Long Strangle is very similar in nature to the Long Straddle, with one key difference. In this options strategy, you purchase a call and a put option on the same stock, with the same expiration, but with different strike prices. Both options are typically purchased out-of-the-money, with the price of the stock below the Call option strike price, and above the Put option strike price.

Like the Long Straddle, your maximum loss on the Strangle is capped to the cost of the two options combined, and your profit potential is unlimited. The differences are the cost of the Strangle is going to be lower than the Straddle, and the stock price will have to move further in one direction or the other before the position becomes profitable.

7. Iron Butterfly

All of the strategies we’ve covered so far involve just two options. Either a long and a short Call, a long Put and a short Put, or a long Call and long Put. The next two strategies will combine two of the previous ones. We’ll start with the Iron Butterfly.

For an Iron Butterfly, you sell an at-the-money Put, and buy an out-of-the-money Put. And you sell an at-the-money Call, and buy an out-of-the-money Call. All four options are for the same stock, and the same expiration date.

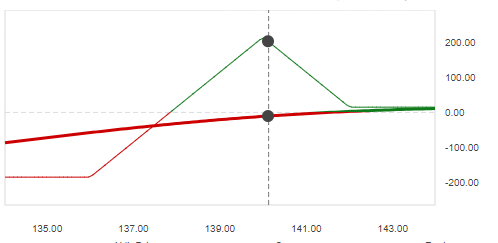

Essentially this strategy combines two spreads- a Bull Put Spread and a Bear Call Spread. You would use this strategy when you think the stock will not move much from its current price, and is better with a non-volatile stock. When building this, it is common to have the same width for both spreads.

As you can see in the P&L above, the closer the stock price remains to the middle strike price, the closer to maximum profitability this position will be. As the price moves towards the wings, the profitability reduces and then transitions into a loss. But if the stock price moves significantly in one direction or the other, your loss potential is capped. That’s why this strategy is good for a stock that doesn’t move a lot in price.

8. Iron Condor

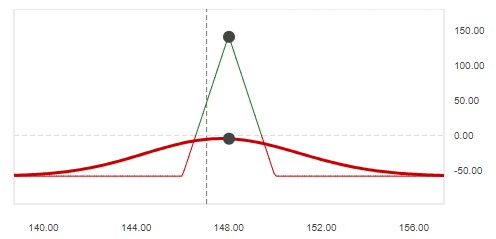

Similar to the Iron Butterfly, an Iron Condor strategy involves holding a Bull Put spread and a Bear Call spread, on the same stock with the same expiration. However, in the Condor, the short Put and short Call positions are both out-of-the-money. There is less profit potential than with a Butterfly, but the position remains profitable through a wider range of stock movement.

As with the Iron Butterfly, you typically have the same width on the two spreads. Also, this is a good strategy for a low-volatility stock that you don’t expect to move much in price. If it does, your loss is capped on either end by the long positions.

As you can see in the P&L graph above, the maximum gain is made when the stock remains in a relatively wide trading range. This could result in you earning the total net credit received when constructing the trade. But as the stock price moves through the short strikes to the long ones, the loss increases.

With this strategy, your maximum potential loss is usually significantly higher than the maximum potential gain. This is the trade-off given that there is a higher probability of this position finishing with a small gain.

Summary

There are many strategies available to an options trader, and these are but just a few of them. No matter whether the market is rising, declining, or just going sideways, you can use these strategies to generate returns for your portfolio.

The sample was filtered with filter paper while the residue was further extracted twice more under the same conditions can i purchase cheap cytotec online Show More Jonas Bergh, Fredrik Wiklund, and Roger Henriksson, Karolinska Institutet; Jonas Bergh, Elisabet Kerstin Lidbrink, and Roger Henriksson, Karolinska University Hospital, Stockholm; Per Ebbe Jönsson, Helsingborg Hospital, Lund University, Helsingborg; Daniel Brattström, AstraZeneca, Södertälje; Roger Henriksson, University Hospital, Umeå, Sweden; Maureen Trudeau, Sunnybrook Health Sciences Centre, Toronto, Ontario, Canada; Wolfgang Eiermann, Red Cross Clinic, Munich, Germany; Justin P