How To Get Started In Options Trading

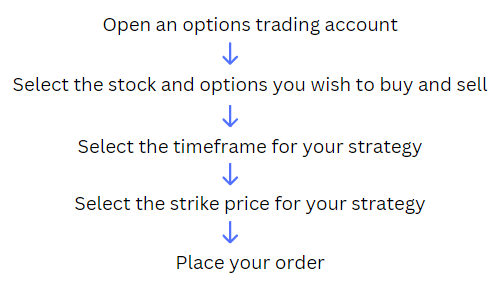

So, how does one get started in options trading?

Options trading isn’t to be entered lightly, as with all financial investing it requires research; educating yourself on the methods and strategies is important as you gain experience, requiring also some capital and a broker.

Let’s explore some essential steps to get started!

Open an Options Trading account

The first thing you need to do in order to start trading options is open an options trading account at a broker. If you’re already investing in stocks you’re probably already using one. However, there are many brokers to choose from.

It is in your best interest to review the pros and cons of each to see which fits your goals. For example, some may offer lower commissions while others may charge higher fees. Some popular broker services are: E-trade, Robinhood, Ameritrade, Interactive Brokers, just to name a few.

As with all investments, your broker is going to ask you some questions about your assets and trading history. This gathering of information will be used to help determine your risk level so they can determine what level of options trading to allow you to do.

Options trading levels

Not all options strategies carry the same risk. Some options, such as a covered call, are very low risk. While other options, like a naked call, are extremely risky. For this reason, most brokerages have different levels you will be approved to trade at which limit the types of options positions you can open.

Using Etrade as an example, there are four options trading levels, 1, 2, 3 and 4.

Level 1 is going to be the lowest level, and it will allow you to do Covered calls sold against stocks held long in your brokerage account, Buy-writes (simultaneously buying a stock and writing a covered call), and Covered call roll-ups/roll-downs. That’s it.

Level 2 adds additional capabilities, including Synthetic long puts, Married puts, Long calls, Long puts, Long straddles, Long strangles, Covered puts (short stock and short put position), and Cash Secured Puts.

Level 3 adds Debit spreads, Credit spreads, Calendar spreads, Diagonal spreads, Naked Short Puts, Butterfly spreads, and Iron condors. If you’re at level 3, you can do almost all of the different options strategies that are available.

Level 4 is the highest level, and adds just one more strategy to your toolkit- Naked Calls.

Pick the Stock and the Options to Buy and Sell

Now you have an account, and your broker has assigned you an Options Trading Level, what next?

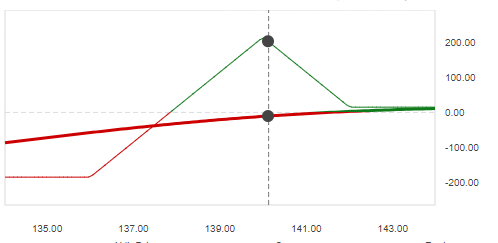

Well now you need to select the stock you want to trade on, and the options you are going to buy and/or sell. You know your portfolio risk level, now you need to consider which direction the underlying stock will move in order to determine the type of options you select.

Will the stock price rise? Decrease? Or not fluctuate much at all? Take into consideration your goal – are you looking to make income from selling option premiums or to offset risk of a potential loss? Broker apps have tools to help identify the best options that match your criteria. But I recommend researching yourself also as each broker site has a wealth of information available.

Review the risks vs the reward- know what you are prepared to risk so you can cap the loss potential.

Think about the implied volatility of the stock as this plays a huge part in pushing up the price of premiums and therefore profit should your goal be income from option premiums. Whereas if the implied volatility is low the premiums are less which could be a good time to buy if you believe the the price will increase.

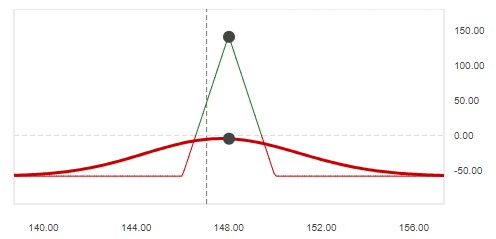

Strategy Selection

You have all your ducks in a row, now you need to select the right strategy. There is an abundance of strategies you can use to capitalize and prevent losses with options trading. I am actively sharing my knowledge on options trading strategies here as well as on my YouTube channel.

With so many strategies available it can at first seem intimidating and you may be unsure of which one to use. Start with something simple, build your knowledge and take the time to learn what will work best for you and your goals.

Determine the Time Frame of the Option

Time value is such an important part of an option’s pricing, and every option has their own individual expiration date. Options that expire in a short time frame (daily or weekly) tend to be considered higher risk as if the stock declines or rises rapidly, there may not be enough time to recover before expiry.

Longer option expiration dates provide more time for the stock to move and your strategy to play out – potentially in your favor.

Determine the Option Strike price

When you enter in to an option contract, you have to think about the direction you expect the stock price to go. You want the strike price to reflect where you predict the stock will lie during the lifetime of the option. This will also help you determine the best strategy of buying or selling puts or calls in order to maximize your position.

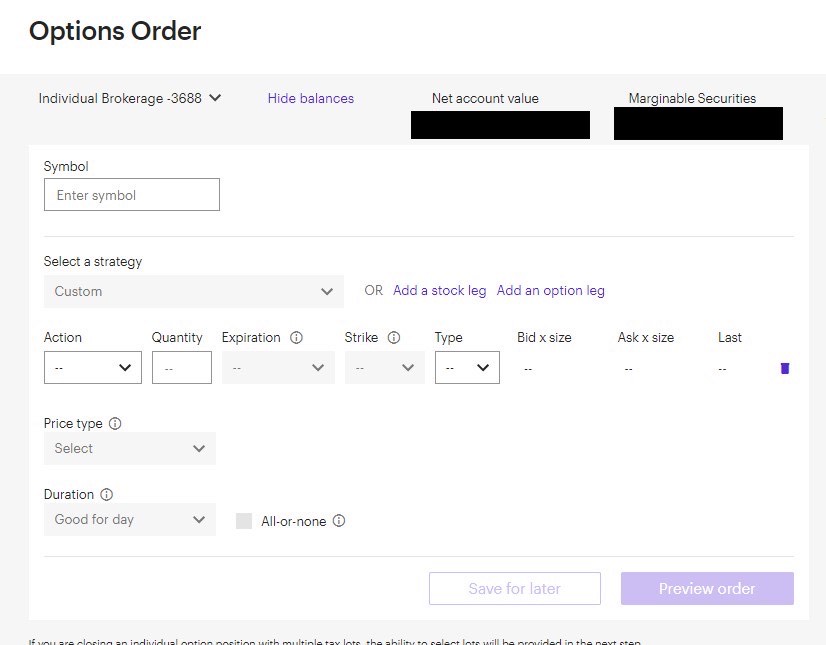

Place the Order

You’ve opened an account, you’ve evaluated your risk tolerance, you’ve chosen a strategy, and selected your strike price and expiration date. Now it’s time to place the order!

Get experience trading stocks first

If you’ve never traded stocks before, you should probably wait to get into options trading. Options are a derivative of stocks, and you should really have a good understanding of how stocks work before getting into it.

Options carry a higher level of risk than stocks, so your brokerage isn’t likely to let you start options trading without some stock experience. Or if they do, it will be on a very limited basis,

In Conclusion…

Options trading offers great potential for a passive income if you are willing to put in the time to strategize correctly. You can read about how my journey started in my earlier post “Why Options Trading?”. Questions and comments are always welcome!

Great article. Curious, is

It possible in a future follow up article to share recommend amounts for beginning,

intermediate and experienced investors that want to take a look at options trading but have never done it before? How much money upfront should they start off with ?

This could be a very interesting topic to discuss. Thanks for the suggestion!

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

Normally I do not learn post on blogs, however I wish to say that this write-up very forced me to try and do so! Your writing taste has been surprised me. Thanks, very great post.

Hey! Someone in my Myspace group shared this website with us so I came to look it over. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Terrific blog and wonderful style and design.

What i do not understood is in truth how you’re now not actually much more well-preferred than you may be now. You’re very intelligent. You realize thus considerably in the case of this topic, made me in my view believe it from numerous various angles. Its like men and women don’t seem to be fascinated except it is something to do with Girl gaga! Your personal stuffs outstanding. All the time maintain it up!

Your house is valueble for me. Thanks!…

Howdy! I’m at work surfing around your blog from my new apple iphone! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the excellent work!