Intrinsic and Extrinsic Values in Options Pricing

Ever wonder how the price of options are determined? When it’s weeks or months out, it can be significantly different than just the difference between the strike price and the current stock price. And even when it’s OTM (Out of the money), there can be a steep premium.

However, as an option approaches expiration the price more closely reflects the difference between the strike price and the stock price if it’s ITM (in the money), or gets very close to zero if it’s OTM.

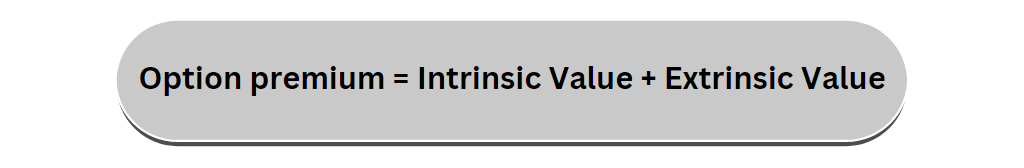

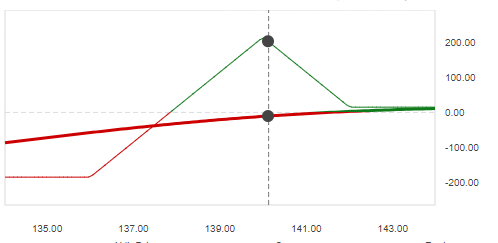

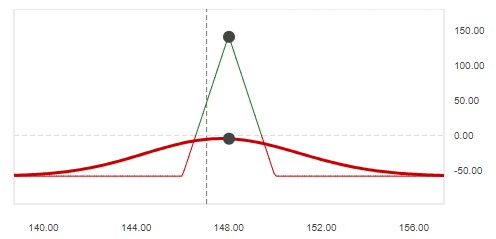

So, what’s going on here? Very simply, there is a time value of an option called extrinsic value, and an actual value of an option at execution (or expiration) called intrinsic value. And these two values add up to make the option premium.

Pricing Options Premiums

In Options trading, intrinsic and extrinsic values represent a measure of what the option contract is worth. This is what defines the option contract premium, or the option’s current market price.

Like the traditional definitions of the words, intrinsic refers to the value based on the stock price vs strike price. And extrinsic value is reliant on external sources, specifically time and volatility.

The price of the option decreases as it approaches the expiration date, so if I was to sell an option I would want the extrinsic value to decline as quickly as possible to capture some profit. But if I was to buy an option, I would want the intrinsic value to rise more in order to offset the decay in extrinsic value.

Let’s break it down on what each of these values mean and their role in determining an option’s premium.

Intrinsic Value

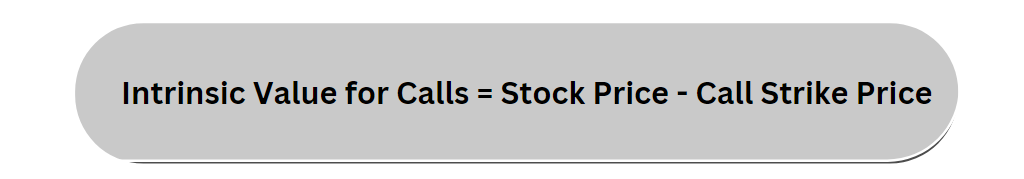

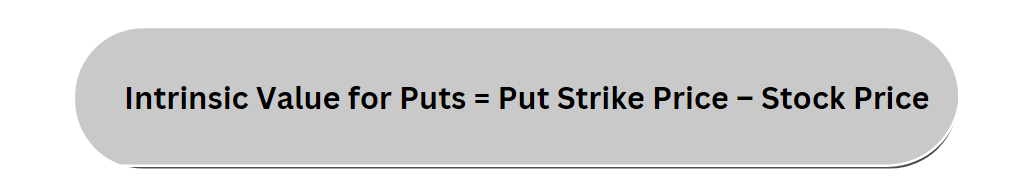

Intrinsic value is the fundamental value of what the asset, the option contract, is deemed to be worth in real time. It represents the value of the option if it were to be exercised today and is ‘in-the-money’. If the option was OTM, the intrinsic value would be zero because it’s of no execution value. The value is determined by calculating the difference between the option’s ‘in-the-money’ strike price and the stock price.

For Calls, the intrinsic value exists if strike price is below the current option price.

For Puts, the intrinsic value exists if strike price is above the current stock price.

Let’s look at an example- say that stock A’s stock price is $300 and has a strike price of $200:

Call’s Intrinsic Value = $300 – $200

Therefore the intrinsic value of stock A = $100

Now you can see stock A’s intrinsic value if the option were to exercised immediately.

What if stock A’s stock price was $190 with a strike price of $200?

Intrinsic Value = $190 – $200

The intrinsic value of stock A = -$0

Once the intrinsic value falls below zero it is OTM and no longer of any value.

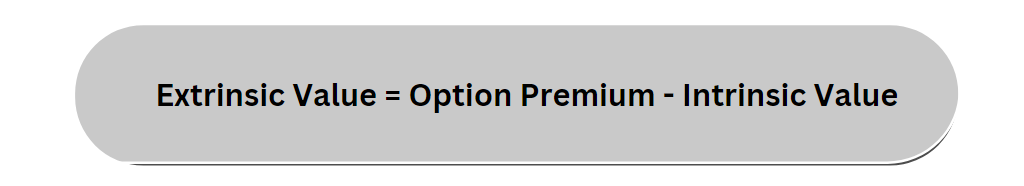

The intrinsic value must be calculated before the extrinsic value can be calculated. With that being said, let’s explore extrinsic value and what it means to options.

Extrinsic Value

An option’s extrinsic value is equal to the difference between the stock price and its intrinsic value. It is only present when the option price is greater than the intrinsic value.

The extrinsic value is reliant on time and implied volatility. The time to the expiration date is the main factor on the extrinsic value, typically the closer an option gets to the expiry date the more its value declines and the less chance it has of increasing. The implied volatility is the prediction that the stock option will go a certain direction – up or down – with the what time is remaining.

Now you know how instrinsic and extrinsic values determine an option`s premium. It is important to understand these values when choosing your options strategy, the more you know of the comprising factors the better decisions you will make.

Options trading can be complex but it doesn`t have to be. If you have any questions or comments please reach out via the commens below or the contact page!

Thank you for sharing superb informations. Your website is so cool. I am impressed by the details that you’ve on this blog. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found just the information I already searched everywhere and just couldn’t come across. What a great site.

Thanks , I’ve recently been looking for info about this subject for ages and yours is the best I’ve discovered so far. But, what about the conclusion? Are you sure about the source?

Aw, this was a really nice post. In thought I wish to put in writing like this additionally – taking time and actual effort to make a very good article… however what can I say… I procrastinate alot and on no account seem to get one thing done.

You made some decent points there. I looked on the internet for the subject matter and found most people will approve with your site.

I dugg some of you post as I thought they were very useful handy