My Favorite Three Legged Options Strategy- The Skip Strike Butterfly

For the first year or so that I traded options, I stuck with the basics. Covered calls, Naked Puts, eventually moving on to Bull Call and Bull Put spreads, as well as Bear Put and Bear Call spreads. After some time, I also started to use more complicated option strategies, like Butterflies and Condors. If you’re not familiar with all of these strategies, here is a good overview. Over the last six months, there’s another strategy I’ve taken a liking to for making big profits- a three legged Call option strategy called the Skip Strike Butterfly.

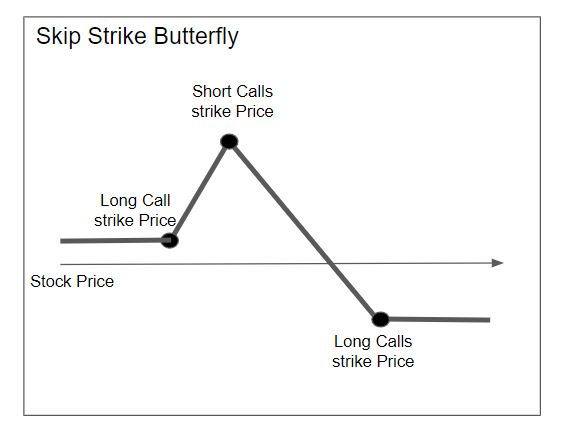

So what is a Skip Strike Butterfly? This is a position built from three different Call options. You buy one Call option with a strike at or below the current stock price (in-the-money or at-the-money). You then sell three Call options at the next strike price above the first. Followed by buying two Call options at a strike price double the range of the first two positions.

For example, you might buy the two long positions at a strike price of 100 and 115, and sell the short position with a strike of 105.

What you end up with looks like this-

It looks a lot like a Butterfly Spread, doesn’t it? It’s essentially a small Bull Call Spread and a larger Bear Call Spread put together that overlap at the short call position. The embedded Short (Bear) Call Spread offsets the cost of the Long (Bull) Call Spread, making it possible to establish this strategy for a net credit or a relatively small net debit. However, the larger short call spread also adds more risk than with a traditional butterfly.

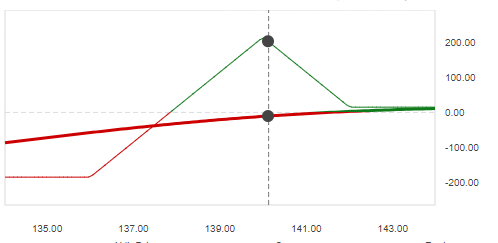

You would use a strategy like this when you think the stock might go up a little, but not much. You don’t want to be holding this position if the stock skyrockets. Ideally, you would open this position for a small credit. That way if the stock holds, or even drops, you still make a profit on the trade.

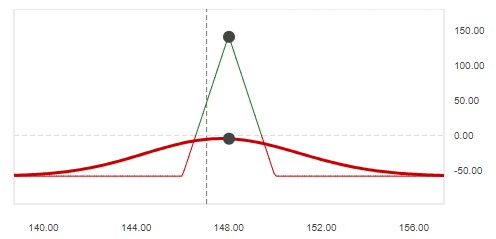

One way to reduce the risk on this position is to open it at a ratio of 1-2-1 instead of 1-3-2. Your initial credit is going to be a lot smaller, but the risk potential will also be smaller. You’ll also be profitable at a wider price range doing this.

Another thing to keep in mind with this strategy, it works better the less volatility there is. Index tracking stocks, like SPY, QQQ, etc., are a good one to use with this for that reason.

Do you ever use this strategy? How has it worked for you? Let me know in the comments.

I have not checked in here for a while because I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

I will right away grab your rss as I can not find your e-mail subscription link or newsletter service. Do you’ve any? Kindly let me know so that I could subscribe. Thanks.

certainly like your web-site but you need to check the spelling on several of your posts. Several of them are rife with spelling issues and I find it very troublesome to tell the truth nevertheless I will certainly come back again.

Hello There. I found your weblog the use of msn. This is a really well written article. I will make sure to bookmark it and return to read extra of your useful information. Thank you for the post. I’ll definitely return.

I reckon something really interesting about your web blog so I saved to favorites.

F*ckin’ tremendous issues here. I’m very happy to look your post. Thank you a lot and i am looking forward to contact you. Will you kindly drop me a mail?

Great post. I am facing a couple of these problems.

I really appreciate this post. I’ve been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again!

It’s actually a nice and useful piece of information. I’m glad that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Very interesting subject, thankyou for posting. “It is much easier to try one’s hand at many things than to concentrate one’s powers on one thing.” by Quintilian.

I got what you intend, regards for posting.Woh I am glad to find this website through google. “It is a very hard undertaking to seek to please everybody.” by Publilius Syrus.

Hello. splendid job. I did not expect this. This is a fantastic story. Thanks!

Hiya, I am really glad I’ve found this information. Today bloggers publish only about gossips and internet and this is really irritating. A good website with interesting content, that’s what I need. Thanks for keeping this web site, I will be visiting it. Do you do newsletters? Can not find it.

fantastic points altogether, you simply gained a brand new reader. What would you suggest about your post that you made a few days ago? Any positive?

Hi, Neat post. There’s a problem together with your site in web explorer, could check this?K IE still is the market chief and a big component to other people will leave out your fantastic writing due to this problem.

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

I truly value your piece of work, Great post.

Hello! Do you use Twitter? I’d like to follow you if that would be ok. I’m definitely enjoying your blog and look forward to new updates.

I believe you have noted some very interesting details, thanks for the post.

Usually I don’t read article on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, very nice post.

Greetings! I know this is somewhat off topic but I was wondering if you knew where I could locate a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Lovely just what I was looking for.Thanks to the author for taking his clock time on this one.

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

I have read a few excellent stuff here. Certainly worth bookmarking for revisiting. I surprise how so much attempt you set to make this type of great informative website.

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

Most of what you assert is astonishingly accurate and it makes me wonder the reason why I had not looked at this with this light before. This piece really did switch the light on for me as far as this issue goes. But at this time there is actually one issue I am not really too comfy with and while I attempt to reconcile that with the core idea of the position, let me observe exactly what the rest of your visitors have to point out.Nicely done.

WONDERFUL Post.thanks for share..extra wait .. …

As a Newbie, I am continuously browsing online for articles that can aid me. Thank you

Some genuinely good articles on this website, regards for contribution. “A liar should have a good memory.” by Quintilian.

Pretty! This was a really wonderful post. Thank you for your provided information.

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four e-mails with the same comment. Is there any way you can remove me from that service? Cheers!

Do you have a spam issue on this blog; I also am a blogger, and I was wondering your situation; many of us have developed some nice procedures and we are looking to trade techniques with others, please shoot me an e-mail if interested.

Kantorbola merupakan pilihan terbaik bagi para penggemar slot online di Indonesia. Dengan berbagai permainan menarik, bonus melimpah, keamanan terjamin, dan layanan pelanggan yang unggul.

Daftar dan login ke Kantorbola versi terbaru untuk pengalaman bermain bola online terbaik. Ikuti panduan lengkap kami untuk akses mudah, fitur unggulan, dan keamanan terjamin.

My brother suggested I would possibly like this blog. He was once totally right. This publish actually made my day. You can not imagine simply how a lot time I had spent for this info! Thank you!

Very interesting information!Perfect just what I was searching for!

It’s hard to seek out knowledgeable folks on this topic, however you sound like you know what you’re talking about! Thanks

Utterly written content, Really enjoyed looking through.

Awsome article and right to the point. I am not sure if this is truly the best place to ask but do you guys have any ideea where to get some professional writers? Thanks in advance 🙂

Normally I don’t read article on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, quite nice article.

Wow! Thank you! I continuously needed to write on my website something like that. Can I take a fragment of your post to my site?

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

I like this site its a master peace ! Glad I observed this on google .

You are my aspiration, I have few blogs and often run out from to brand.

Hi there, I found your website by the use of Google while looking for a comparable matter, your website came up, it looks good. I have bookmarked it in my google bookmarks.

It provides an excellent user experience from start to finish.

LOTTOCHAMP

LOTTO CHAMP REVIEWS

I’m really impressed by the speed and responsiveness.

Christopher Nolan’s storytelling is always mind-blowing. Every movie feels like a masterpiece, and the way he plays with time and perception is just genius.

Good post and right to the point. I am not sure if this is actually the best place to ask but do you folks have any ideea where to hire some professional writers? Thanks in advance 🙂

Aw, this was a really nice post. In concept I would like to put in writing like this moreover – taking time and precise effort to make a very good article… but what can I say… I procrastinate alot and by no means appear to get something done.

Some really superb articles on this web site, regards for contribution. “The key to everything is patience. You get the chicken by hatching the egg, not by smashing it.” by Arnold Glasgow.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

Of course, what a fantastic blog and educative posts, I will bookmark your blog.Have an awsome day!

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

Merely wanna admit that this is extremely helpful, Thanks for taking your time to write this.

Your place is valueble for me. Thanks!…

Howdy! This post could not be written any better! Reading this post reminds me of my previous room mate! He always kept talking about this. I will forward this page to him. Pretty sure he will have a good read. Thanks for sharing!

Yeah bookmaking this wasn’t a risky determination great post! .

Terrific paintings! This is the kind of info that should be shared around the internet. Disgrace on Google for not positioning this submit higher! Come on over and visit my web site . Thanks =)

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

I was curious if you ever thought of changing the structure of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or 2 images. Maybe you could space it out better?

I like the valuable info you provide in your articles. I’ll bookmark your blog and check again here regularly. I am quite sure I’ll learn many new stuff right here! Best of luck for the next!

Some really nice stuff on this website , I enjoy it.

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

Hello. impressive job. I did not expect this. This is a impressive story. Thanks!

I saw a lot of website but I believe this one holds something extra in it in it

LIPOZEM

LIPOZEM REVIEWS

I want forgathering utile info, this post has got me even more info! .