My Top 5 Mistakes to Avoid When Options Trading

Anyone who does stock or options trading is likely to make mistakes from time to time. And the newer they are to trading, the more mistakes they’re likely to make. This has been no less true for myself.

I’ve now been doing options trading for almost three years. I started small, worked my way to bigger trades, made some mistakes, and then started working my way up again. I’ve learned a lot of lessons along the way, and I thought I’d share these with you so that you can learn from them as well.

One of the things I’ve learned is that there are certain mistakes many traders make that prevents them from having success. I’ve made some of these same mistakes. Over time, I’ve become more disciplined with my trading, and good at not making these mistakes. Now I’ll share this knowledge with you.

Here are my five top things not to do when options trading:

Don’t rush into trades

A big part of any options or stock trading strategy is patience. Stocks generally move in patterns that can be idenitfied by doing basic chart analysis. When you start to recognize those patterns, you can also start to predict when reversals in that pattern might happen.

This can take time to develop though. If you enter too early, opening a bearish trade while the stock is still rising, or a bullish trade while the stock is still falling, you can find yourself quickly in a negative position. Wait until that stock has hit a point of resistance or support before opening your position.

It’s also a good idea to avoid times of high volatility. If there’s an earnings announcement coming up, a suprise to the upside or downside can swing a stock price pretty significantly. Wait until after earnings, and once the dust settles open that position.

Macro events can have a big impact on stocks as well. Big changes in interest rate policy, new jobless claim numbers, or GDP can all cause sudden and dramatic movements in stocks. Rather than trying to time the market, let these events pass before opening new positions.

It’s better to wait than to rush into trades that go negative quickly. There are unexpected events that can happen that you can’t avoid. But on average, if you are patient with your trades, you can avoid unnecessary loss.

Don’t put more than 10% of your account on the line

You will have trades that lose money. That’s just a fact of life when doing stock or options trading. But if you’re patient, you won’t have too many of these.

So how do you ease the pain when you do? The best way is to minimize your losses when they occur.

One way of doing that is by not risking a lot on any individual trade. Generally, I try to not have more than about 10% of my trading account at risk from my options positions at any given time. That way, if things turn south in a hurry I’ve got the ability to buy my way out of the positions or just take the full loss without setting me back too far.

In actuality, because my individual positions represent much less than the 10%, a sudden shift in any single postion just isn’t going to affect me very much. I don’t like it when it happens, but it doesn’t keep my up at night either.

Don’t stay put when a position goes negative

This one goes hand in hand with being patient. Sometimes, you will wait for a good time to open a position only to see the trade go negative right away. Sometimes, things will trend in the right direction, only to suddenly change.

You have two choices at this point- you can wait and see if it reverses again in your favor, or you can close the position.

I’ve found that more often than not that when this happens it’s best for you to get out of the position right away. Usually, you will be able to do this with only taking a partial loss. Whereas waiting can and usually will lead to even greater losses.

Think about it like this- either way you choose can be the wrong decision. If you close the position early and take the loss, and then things reverse, you’ve probably only taken a partial loss. But if you stay in the position expecting it to change, and it doesn’t, you can lose the full amount on the trade.

Nobody likes to be wrong, but it’s better the smaller wrong you are. Cut your losses when you can.

Don’t chase losses with more losses

This is probably the single biggest mistake rookies make. They open a position, then it goes negative. So they open the new position with an even bigger risk to make up for the loss on the first. This can escalate quickly.

Anytime I take a loss on the position, I take a look at what went wrong. I also take a look at all of my other positions to make sure I haven’t made the same mistake. And that’s it. I take the loss and move on.

If you’re risking small percentages of your account on your positions, and you’re being patient about the positions you open, and you get out of losing positions quickly, you won’t even need a reason to chase losses. They’ll happen, but your other positions will more than make up for it without having to open any new, potentially riskier positions.

Take the loss and move on.

Don’t split spread positions

This is one I don’t see talked about much out there. It could be that this is a mistake that I’ve made that isn’t actually that common for other options traders. But it’s a mistake that’s both earned me big profits, and cost me big losses. Let me explain what it is and how I’ve been burned by it.

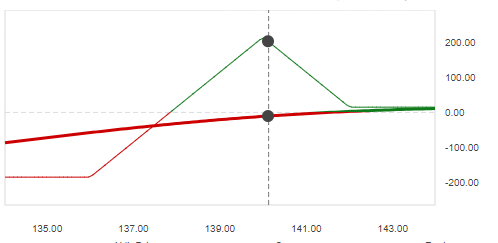

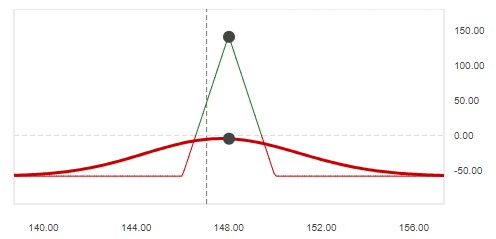

I do a lot of vertical spread trades. This is where you simultaneously open long and short Call or Put positions on the same stock with the same expiration date. The major benefit of spreads is your cost or risk on the short position is capped by the long position. And if you open it as a debit spread, the short position premium offsets a big portion of the long position premium.

One of the things I’ve done in the past is to open these spreads pretty far out. Stocks tend to move up and down on a short term basis as they rise or fall over the long term. And if the stock moves in the direction I want, the price on both options can drop significantly. If I’ve still got a lot of time, I can buy back the short position for a large gain (profit), and then wait for the stock price to move back in the other direction to sell a new short position.

As long as the stock makes that reversal and moves significantly back in the other direction, this can be a very profitable move. I’ve already made a large profit with the first short position, larger than I could have made with the spread. And because the stock is moving back, when I sell a new short position I can once again cover the cost of the long position. Or, if the stock moves significantly, the long position itself can become very profitable.

I’ve done this several times in the past, multiplying my potential profit 3, 4, even 10 times more than what I could have done with just the basic spread. But this requires the stock to first move in the direction that’s best for reducing the price on the options, and then once the short position has been closed, it needs to move back in the other direction.

But what happens if you buy back the short position, and then the stock never reverses course?

This is where things can get ugly. The cost to buy back the short position can can be many times larger than the initial maximum risk amount on the spread. If the stock never reverses, that cost is sunk. You can sell your long position, but by this time it’s lost so much value you won’t get much for it.

Splitting the spread can not only increase your profits by several times over, it can increase your losses several times over as well.

The first couple times I did this, my profits were huge. But the stock has to move in the directions you want for it to work, and that doesn’t always happen. Because of the risk potential, it’s just not worth trying it. If your spread is profitable, take the profit and move on. If your spread isn’t profitable, close it and move on. Don’t turn it into a major loss by trying to time the market and splitting up your spread.

It’s ok to make small mistakes

Being successful in trading is more about consistency than big wins. When you’re trading on a regular basis, mistakes will be made. But as long as you don’t make any of the five big ones above, you can avoid significant losses.

There are other things you want to make sure you don’t do when options trading, but these are some of the biggest mistakes I’ve learned to avoid. I’m a better trader now as a result, and hopefully it will help you become a better trader as well.

What¦s Going down i’m new to this, I stumbled upon this I have discovered It absolutely useful and it has aided me out loads. I’m hoping to contribute & aid other users like its aided me. Good job.

After research a couple of of the weblog posts in your website now, and I really like your manner of blogging. I bookmarked it to my bookmark web site checklist and might be checking again soon. Pls check out my site as well and let me know what you think.

It’s actually a great and useful piece of info. I am glad that you shared this useful info with us. Please keep us up to date like this. Thanks for sharing.

Absolutely indited content, thanks for entropy.

This design is wicked! You certainly know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

very good publish, i definitely love this web site, keep on it

I?¦ve recently started a website, the info you provide on this website has helped me greatly. Thank you for all of your time & work.