Selling Covered Calls- A Low-Risk Way to Generate an Income

What are covered calls?

We know that a ‘Call’ refers to the right (with no obligation) to buy a stock at a specified price within a certain time frame, and that a single option contract is for 100 shares of the underlying stock. It’s an agreement between an option seller and an option buyer where the seller receives a premium from the buyer who is paying for that right, and the seller keeps that premium regardless of how the markets move.

A ‘Covered Call’ is a when you are selling the option on stock that you already own. For most options traders, this is the only type of Call you can sell.

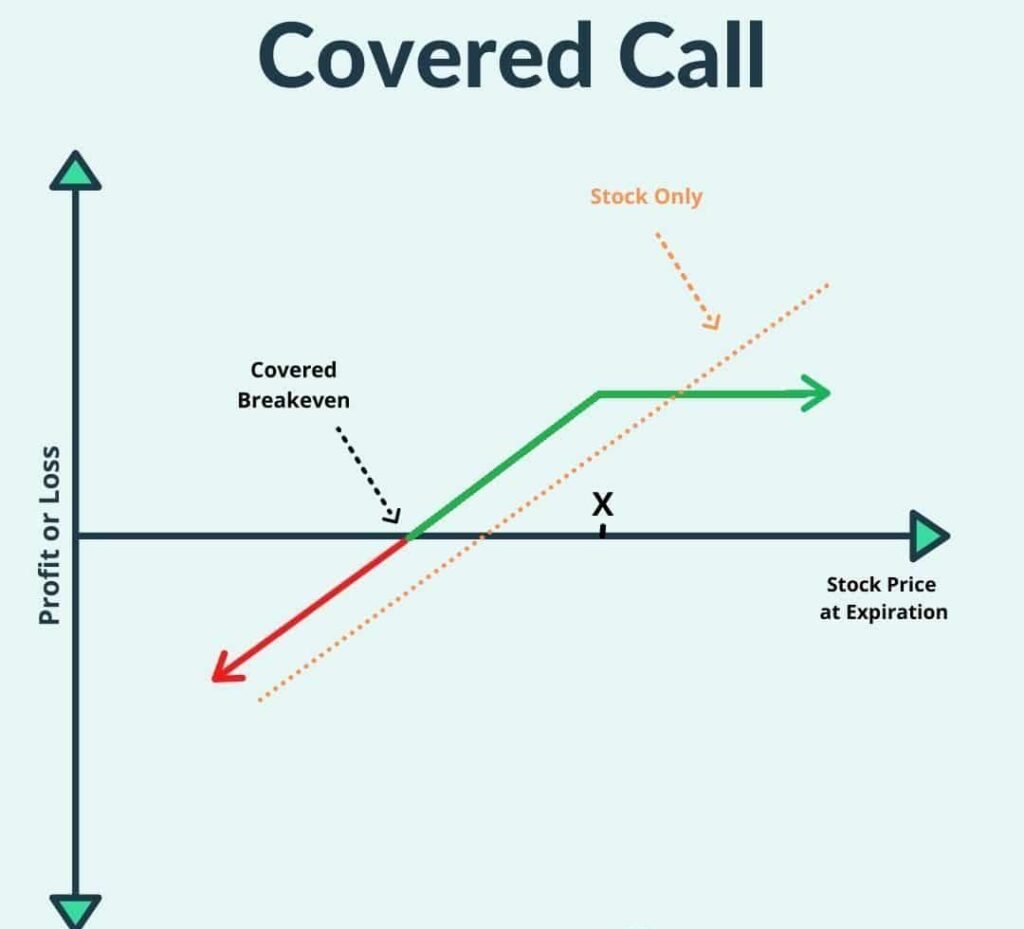

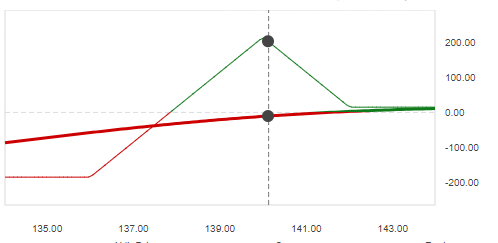

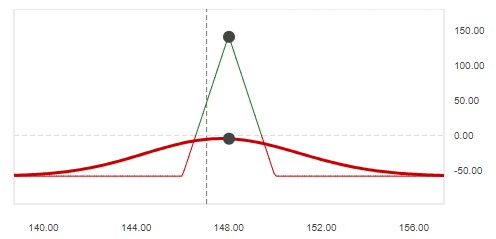

Profitability

The profit potential lies in the income generated in collecting the Option premium, plus potentially more in the sale of the stock. But no matter which way the stock price moves, that premium is yours to keep.

If the Option finishes ITM (stock price above the strike price), as a seller you would receive the option premium and sell the stocks at the strike price. So your overall profit would be the option premium, plus the difference between the strike price and the price you purchased the stock for.

If the Option finishes OTM (stock price below the strike price), you would still receive the option premium, and you would retain your stock.

Unfortunately for the buyer, their option would expire worthless in this situation.

Risk

When you sell an option to open the position, it’s considered a short option. If the stock doesn’t go the direction you want it to, you can be on the hook for potentially big losses. Selling it covered essentially protects you from losses on the option if the stock skyrockets because you’re already holding the stock to sell. If you didn’t own the stock, you would have to buy it on the open market to cover your position, potentially at a significantly higher price than you have committed to sell it at (your strike price).

The greatest risk of this strategy actually isn’t on the option itself, but on the stock. When you’re holding 100 shares of a stock, and the price falls dramatically, the value of your position decreases with it. However, if you’re able to hold on to the stock until the price recovers, you never actually take this loss. And as a reminder, you keep the option premium no matter what.

As you can see, a Covered Call is actually a very low risk options strategy.

Overall, using covered calls is a simplistic way to generate an options premium income with generally low risk. It’s also a very beginner friendly strategy, great for new investors as they start to navigate through options trading. But it’s also used by experienced investors, and many times along with other strategies.

Is there an options trading strategy you use often or would like explained? Leave a comment or send a message!

There is noticeably a bundle to learn about this. I assume you made sure good points in options also.

My spouse and i were quite joyous that Emmanuel managed to round up his reports out of the precious recommendations he obtained using your web page. It’s not at all simplistic to just be making a gift of tactics which other folks have been trying to sell. And we take into account we need the blog owner to appreciate for that. The type of illustrations you have made, the simple web site navigation, the friendships your site give support to foster – it is everything great, and it is letting our son in addition to our family believe that this article is brilliant, which is wonderfully indispensable. Thanks for all!

I really appreciate this post. I?¦ve been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again

I’m very happy to read this. This is the kind of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this best doc.

Thank you for any other magnificent post. The place else may just anybody get that kind of information in such an ideal method of writing? I have a presentation next week, and I am on the look for such info.

Thanks for another informative blog. Where else could I get that kind of info written in such a perfect way? I have a project that I’m just now working on, and I have been on the look out for such info.

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

Hello my family member! I want to say that this article is awesome, nice written and include approximately all important infos. I?¦d like to peer extra posts like this .

Hey! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My site discusses a lot of the same topics as yours and I feel we could greatly benefit from each other. If you might be interested feel free to send me an e-mail. I look forward to hearing from you! Great blog by the way!

You made some nice points there. I looked on the internet for the subject matter and found most people will agree with your blog.

WONDERFUL Post.thanks for share..more wait .. …

Just wish to say your article is as astonishing. The clarity in your submit is just great and i could assume you’re knowledgeable in this subject. Fine together with your permission allow me to snatch your RSS feed to stay up to date with coming near near post. Thank you one million and please continue the enjoyable work.

I used to be suggested this blog through my cousin. I’m no longer sure whether or not this publish is written via him as nobody else recognize such specific about my difficulty. You are incredible! Thank you!

hello!,I like your writing so a lot! proportion we be in contact extra about your article on AOL? I require a specialist on this space to unravel my problem. May be that is you! Looking forward to look you.

I’m not sure exactly why but this blog is loading extremely slow for me. Is anyone else having this issue or is it a issue on my end? I’ll check back later and see if the problem still exists.

I am now not sure the place you’re getting your information, but great topic. I must spend a while learning more or figuring out more. Thanks for magnificent info I used to be looking for this information for my mission.

I have read several excellent stuff here. Certainly worth bookmarking for revisiting. I surprise how a lot effort you set to make any such fantastic informative site.

Great beat ! I wish to apprentice while you amend your website, how could i subscribe for a weblog site? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided vivid transparent idea

You actually make it seem really easy with your presentation however I to find this topic to be actually one thing that I believe I might by no means understand. It sort of feels too complicated and very vast for me. I’m taking a look ahead to your subsequent submit, I?¦ll try to get the hold of it!

Some truly wondrous work on behalf of the owner of this web site, utterly great written content.

Its fantastic as your other articles : D, thankyou for putting up. “Love is like an hourglass, with the heart filling up as the brain empties.” by Jules Renard.

I’ve been surfing online more than three hours these days, but I by no means found any fascinating article like yours. It¦s lovely value sufficient for me. Personally, if all website owners and bloggers made just right content material as you probably did, the net will likely be much more helpful than ever before.

I went over this site and I think you have a lot of fantastic info, bookmarked (:.

Hello my friend! I want to say that this post is amazing, nice written and come with almost all significant infos. I’d like to peer more posts like this.

You have remarked very interesting points! ps decent website.

Thank you so much for providing individuals with an extraordinarily terrific possiblity to check tips from this web site. It really is very nice plus full of a good time for me and my office colleagues to visit your website at least thrice weekly to find out the latest items you will have. And lastly, I’m certainly pleased concerning the remarkable tips you give. Selected 3 areas in this posting are rather the most suitable I’ve ever had.

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is fundamental and everything. But just imagine if you added some great visuals or video clips to give your posts more, “pop”! Your content is excellent but with images and videos, this blog could certainly be one of the best in its niche. Very good blog!

I like what you guys are up too. Such clever work and reporting! Carry on the excellent works guys I’ve incorporated you guys to my blogroll. I think it will improve the value of my web site :).

Kantorbola99 menawarkan pengalaman bermain slot online yang menyenangkan. Platform ini menyediakan beragam pilihan game menarik. Pemain dapat menikmati tampilan grafis berkualitas tinggi.

Kantorbola merupakan pilihan terbaik bagi para penggemar slot online di Indonesia. Dengan berbagai permainan menarik, bonus melimpah, keamanan terjamin, dan layanan pelanggan yang unggul.

I carry on listening to the news talk about getting free online grant applications so I have been looking around for the best site to get one. Could you tell me please, where could i acquire some?

After study a couple of of the blog posts on your website now, and I really like your means of blogging. I bookmarked it to my bookmark website listing and can be checking again soon. Pls take a look at my site as effectively and let me know what you think.

I will immediately grasp your rss feed as I can’t find your e-mail subscription hyperlink or newsletter service. Do you’ve any? Please permit me understand in order that I may just subscribe. Thanks.

Hey there, You have done an incredible job. I’ll certainly digg it and personally suggest to my friends. I’m sure they will be benefited from this web site.

I have recently started a blog, the info you offer on this website has helped me tremendously. Thanks for all of your time & work.

Thank you for any other informative web site. Where else may just I am getting that kind of info written in such an ideal approach? I have a challenge that I’m simply now operating on, and I’ve been on the look out for such information.

I have recently started a blog, the information you provide on this website has helped me tremendously. Thank you for all of your time & work.

I don’t commonly comment but I gotta admit appreciate it for the post on this one : D.

Hello, Neat post. There’s an issue along with your web site in internet explorer, may test this?K IE nonetheless is the market chief and a big section of other people will omit your great writing because of this problem.

I like what you guys are up also. Such smart work and reporting! Keep up the excellent works guys I have incorporated you guys to my blogroll. I think it will improve the value of my web site 🙂

You could definitely see your enthusiasm within the paintings you write. The sector hopes for more passionate writers like you who are not afraid to mention how they believe. Always go after your heart. “We may pass violets looking for roses. We may pass contentment looking for victory.” by Bern Williams.

Hi, i think that i saw you visited my web site thus i came to “return the favor”.I’m trying to find things to enhance my website!I suppose its ok to use some of your ideas!!

I’m still learning from you, as I’m making my way to the top as well. I absolutely enjoy reading everything that is written on your blog.Keep the aarticles coming. I enjoyed it!

Thankyou for helping out, superb info .

You are my aspiration, I possess few blogs and infrequently run out from to brand : (.

Rattling nice style and design and superb articles, very little else we require : D.

I have been examinating out a few of your articles and it’s pretty good stuff. I will make sure to bookmark your blog.

I just could not depart your site prior to suggesting that I actually enjoyed the standard info a person provide for your visitors? Is gonna be back often in order to check up on new posts

I love your writing style genuinely enjoying this website .

Unquestionably believe that which you said. Your favorite reason seemed to be on the net the simplest thing to be aware of. I say to you, I certainly get annoyed while people consider worries that they plainly do not know about. You managed to hit the nail upon the top and also defined out the whole thing without having side-effects , people can take a signal. Will likely be back to get more. Thanks

I like this web site very much, Its a real nice office to read and incur info .

Hi there I am so grateful I found your blog, I really found you by error, while I was looking on Aol for something else, Regardless I am here now and would just like to say thanks for a fantastic post and a all round interesting blog (I also love the theme/design), I don’t have time to browse it all at the moment but I have bookmarked it and also included your RSS feeds, so when I have time I will be back to read much more, Please do keep up the great work.

I think other site proprietors should take this web site as an model, very clean and excellent user friendly style and design, as well as the content. You are an expert in this topic!

Does your blog have a contact page? I’m having a tough time locating it but, I’d like to send you an email. I’ve got some recommendations for your blog you might be interested in hearing. Either way, great site and I look forward to seeing it develop over time.

I must express some appreciation to you just for bailing me out of such a circumstance. After surfing through the online world and obtaining thoughts which were not helpful, I figured my life was done. Being alive without the presence of solutions to the issues you’ve solved all through your post is a crucial case, and those that could have adversely affected my entire career if I hadn’t noticed your site. That talents and kindness in playing with the whole thing was useful. I’m not sure what I would’ve done if I had not come across such a stuff like this. I can at this time relish my future. Thank you very much for the specialized and effective help. I won’t be reluctant to refer your blog to anyone who would need tips about this subject matter.

Great site! I am loving it!! Will come back again. I am bookmarking your feeds also

http://terios2.ru/forums/index.php?autocom=gallery&req=si&img=4547

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

Do you mind if I quote a few of your posts as long as I provide credit and sources back to your webpage? My website is in the exact same niche as yours and my users would certainly benefit from some of the information you provide here. Please let me know if this okay with you. Regards!

hey there and thank you for your info – I’ve certainly picked up anything new from right here. I did on the other hand expertise some technical points the usage of this web site, as I experienced to reload the web site a lot of occasions previous to I may just get it to load properly. I had been thinking about if your hosting is OK? Not that I am complaining, but slow loading circumstances times will very frequently impact your placement in google and can injury your high quality ranking if ads and ***********|advertising|advertising|advertising and *********** with Adwords. Anyway I’m including this RSS to my email and can glance out for a lot more of your respective interesting content. Ensure that you replace this once more soon..

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.