Calendar spreads options, also known as a time spreads or horizontal spreads, are options trading strategies that involve buying and selling options of the same underlying asset, with the same strike price, but with different expiration dates. Calendar spreads profit…

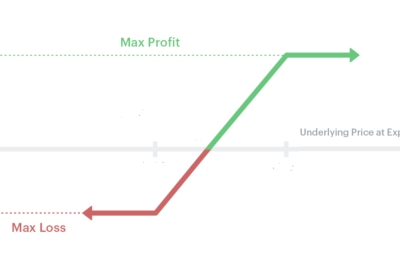

Options vertical spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset, and the same expiration date, but with different strike prices. They are called “vertical” spreads because the different strike prices create…

In options trading the Long Straddle and Long Strangle are strategies that bear certain similarities. Both involve buying an equal amount of calls and puts, with the same expiration date. And both are profitable when there is a significant movement…