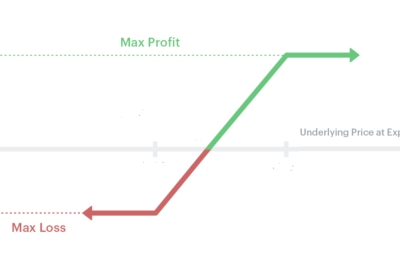

Options vertical spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset, and the same expiration date, but with different strike prices. They are called “vertical” spreads because the different strike prices create…

In options trading the Long Straddle and Long Strangle are strategies that bear certain similarities. Both involve buying an equal amount of calls and puts, with the same expiration date. And both are profitable when there is a significant movement…

With such a large scope of options trading strategies, it is easy to get lost in the complexity of it all. And it’s important to master some basic strategies before diving into the more complicated methods. In this article, we…

What are covered calls? We know that a ‘Call’ refers to the right (with no obligation) to buy a stock at a specified price within a certain time frame, and that a single option contract is for 100 shares of…