Calendar spreads options, also known as a time spreads or horizontal spreads, are options trading strategies that involve buying and selling options of the same underlying asset, with the same strike price, but with different expiration dates. Calendar spreads profit…

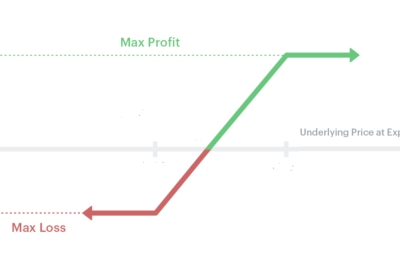

Options vertical spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset, and the same expiration date, but with different strike prices. They are called “vertical” spreads because the different strike prices create…

This past week, ending on April 28th, I made over $1,700 in profit with my options trading. It wasn’t my best week ever, or even in my top ten best weeks. But it was a solid week for me. So,…

So, how does one get started in options trading? Options trading isn’t to be entered lightly, as with all financial investing it requires research; educating yourself on the methods and strategies is important as you gain experience, requiring also some…