The power of the Long Stock Collar Strategy

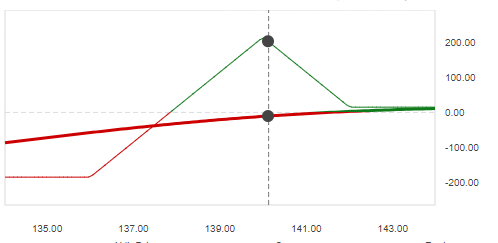

A long stock collar option strategy, also known simply as a “stock collar,” is an options trading strategy that involves holding a long position in a stock while simultaneously using options to limit both potential losses and gains. It is essentially a combination of three components: owning the underlying stock, buying protective puts, and selling covered calls.

Just like how the protective collar on a weight bar keeps the weights from falling off in a sudden shift in balance, the Long Stock Collar protects your stock in case of a sudden shift in price.

How the long stock collar strategy works:

There are three components to a Long Stock Collar- the stock holding, a Protective Put, and a Covered Call.

Long Stock Position: The strategy starts with you holding a long position in a specific stock.

Protective Puts: To protect against potential downside risk, you purchase an out-of-the-money put option. These put options give you the right, but not the obligation, to sell the underlying stock at a predetermined price (strike price) within a specified period (until the option’s expiration date).

Covered Calls: To generate income and offset the cost of buying the protective puts, you sell an out-of-the-money call option. By doing this, you obligate yourself to sell the underlying stock at a predetermined price (strike price) if the stock’s price rises above that level before the call option’s expiration date.

When to use a long stock collar strategy

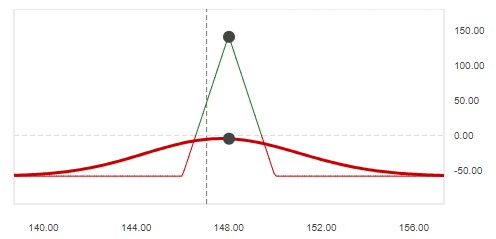

This strategy is suitable when you hold a long position in a stock but you want to protect yourself against potential losses in case the stock price declines. It gives you a protective position.

Buying protective puts comes at a cost in the form of the option premium. If the stock price does not drop significantly or remains above the put option’s strike price, the cost of the put option is essentially a loss. But with the Covered Call portion of this strategy, your Put premium is covered.

This strategy is best used when you believe that the stock’s price will not experience significant gains in the near term. The reason is that this strategy will cap your potential gains if the stock rises significantly.

Use it for Income Generation

If you believe the stock is trading near its peak and is unlikely to rise much more, the covered call portion of the strategy provides a way to generate income through the premiums received from selling the option. Calls typically carry a higher premium than puts, so even with buying the Put, you may be able to receive a net credit when you open the position.

It’s a great way to earn extra returns when a stock isn’t rising. But with the protective put, you’re still covered if the stock falls.

When not to use a Long Stock Collar

This strategy puts a cap on potential gains when a stock is in an uptrend. With the Covered call, you’re obligated to sell the stock at the predetermined strike price if the stock prices rises significantly. If the stock price exceeds this level, you will end up selling the stock, and no additional gains will be realized.

If a stock is generally in an upward movement, there are other strategies that might be better suited for you. Instead of a Long Stock Collar, maybe consider doing Bull Spreads instead.

Before employing any options strategy, it’s crucial to thoroughly understand its mechanics and potential risks. You should carefully assess your risk tolerance, market outlook, and investment goals before implementing a long stock collar strategy or any other options strategy.

Have you used this strategy before? Let me know in the comments.

Модные советы по выбору модных образов на любой день.

Заметки профессионалов, новости, все коллекции и шоу.

https://luxe-moda.ru/chic/499-10-maloizvestnyh-faktov-o-demne-gvasalii/

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

Модные заметки по подбору модных образов на любой день.

Заметки профессионалов, новости, все новые коллекции и шоу.

https://urban-moda.ru/all/749-za-chto-my-lyubim-brend-coach-ikona-amerikanskogo-stilya-i-masterstva/

Would you be excited by exchanging links?

You are my inspiration , I own few blogs and infrequently run out from to brand : (.

It’s a shame you don’t have a donate button! I’d definitely donate to this brilliant blog! I suppose for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to brand new updates and will talk about this website with my Facebook group. Chat soon!

На нашем сайте вы можете найти актуальные промокоды для Lamoda. Используйте их, чтобы сэкономить выгодную покупку на топовые товары. Промокоды проверяются каждую неделю, чтобы вы всегда могли воспользоваться лучшими предложениями.

https://lamoda.fashionpromo.ru

https://socials360.com/story8641421/Сумки-balenciaga

Фирменный интернет-магазин Боттега Венета предлагает полный каталог эксклюзивных товаров от легендарного бренда. В нашем каталоге вы сможете найти и заказать аксессуары актуальных коллекций с доставкой по Москве и России.

Сумки Bottega Veneta

Aw, this was a very nice post. In concept I wish to put in writing like this additionally – taking time and precise effort to make a very good article… but what can I say… I procrastinate alot and under no circumstances appear to get one thing done.

After study a couple of of the blog posts on your website now, and I really like your approach of blogging. I bookmarked it to my bookmark website checklist and will probably be checking back soon. Pls check out my site as well and let me know what you think.

I would like to thank you for the efforts you’ve put in writing this website. I am hoping the same high-grade site post from you in the upcoming as well. Actually your creative writing abilities has encouraged me to get my own blog now. Actually the blogging is spreading its wings fast. Your write up is a good example of it.

I have read several good stuff here. Certainly worth bookmarking for revisiting. I wonder how much effort you put to make such a great informative web site.

I believe this web site holds some real wonderful information for everyone. “I prefer the wicked rather than the foolish. The wicked sometimes rest.” by Alexandre Dumas.

hello there and thank you for your info – I’ve certainly picked up anything new from right here. I did however expertise a few technical points using this site, as I experienced to reload the website many times previous to I could get it to load correctly. I had been wondering if your web host is OK? Not that I’m complaining, but sluggish loading instances times will sometimes affect your placement in google and can damage your high-quality score if ads and marketing with Adwords. Well I’m adding this RSS to my e-mail and could look out for much more of your respective exciting content. Make sure you update this again very soon..

It is in reality a nice and useful piece of information. I am happy that you shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

Heya i am for the first time here. I found this board and I to find It really helpful & it helped me out a lot. I am hoping to offer one thing again and help others like you helped me.

Wonderful blog! I found it while surfing around on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Appreciate it

Absolutely pent content material, thank you for information. “No human thing is of serious importance.” by Plato.

You really make it seem really easy together with your presentation however I to find this topic to be really one thing which I think I would never understand. It kind of feels too complicated and extremely wide for me. I am looking ahead to your subsequent publish, I¦ll try to get the hold of it!

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and everything. However imagine if you added some great visuals or video clips to give your posts more, “pop”! Your content is excellent but with pics and videos, this site could definitely be one of the very best in its niche. Superb blog!

You are my inspiration , I have few blogs and occasionally run out from to post .

Some truly excellent content on this site, thanks for contribution. “There is one universal gesture that has one universal message–a smile” by Valerie Sokolosky.

Some genuinely great information, Glad I found this.

Definitely, what a fantastic website and informative posts, I definitely will bookmark your website.Have an awsome day!

I am glad to be a visitant of this staring blog! , appreciate it for this rare info ! .

Thank you for the good writeup. It in truth was once a amusement account it. Glance complex to more added agreeable from you! By the way, how can we be in contact?

great points altogether, you simply received a brand new reader. What would you suggest about your publish that you made some days in the past? Any sure?

Hello, i think that i saw you visited my blog so i came to “return the favor”.I’m attempting to find things to improve my site!I suppose its ok to use a few of your ideas!!

Your house is valueble for me. Thanks!…

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

I have recently started a website, the information you provide on this web site has helped me tremendously. Thanks for all of your time & work.

I truly enjoy reading through on this web site, it holds wonderful blog posts.

Attractive section of content. I just stumbled upon your weblog and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Any way I’ll be subscribing to your augment and even I achievement you access consistently quickly.

I have not checked in here for a while since I thought it was getting boring, but the last several posts are good quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

I have read a few excellent stuff here. Definitely price bookmarking for revisiting. I surprise how much effort you set to create one of these great informative site.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

That is the fitting weblog for anybody who needs to seek out out about this topic. You notice a lot its virtually onerous to argue with you (not that I truly would need…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, simply nice!

I think other web site proprietors should take this web site as an model, very clean and wonderful user genial style and design, as well as the content. You’re an expert in this topic!

На этом сайте можно ознакомиться с информацией о телешоу “Однажды в сказке”, развитии событий и ключевых персонажах. https://odnazhdy-v-skazke-online.ru/ Здесь представлены подробные материалы о производстве шоу, актерах и фактах из-за кулис.

1ymdpz

Программа видеонаблюдения – это современный инструмент для обеспечения безопасности , объединяющий технологии и удобство использования .

На сайте вы найдете подробное руководство по настройке и установке систем видеонаблюдения, включая онлайн-хранилища, их сильные и слабые стороны.

Новости видеонаблюдения

Рассматриваются гибридные модели , сочетающие облачное и локальное хранилище , что делает систему более гибкой и надежной .

Важной частью является описание передовых аналитических функций , таких как определение активности, идентификация элементов и дополнительные алгоритмы искусственного интеллекта.

Kantorbola merupakan pilihan terbaik bagi para penggemar slot online di Indonesia. Dengan berbagai permainan menarik, bonus melimpah, keamanan terjamin, dan layanan pelanggan yang unggul.

I’ve been exploring for a bit for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this site. Reading this info So i am happy to convey that I have a very good uncanny feeling I discovered just what I needed. I most certainly will make certain to don’t forget this site and give it a look on a constant basis.

На этом сайте представлена полезная информация о терапии депрессии, в том числе у пожилых людей.

Здесь можно узнать способы диагностики и подходы по восстановлению.

http://aguafluorurowashington.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Fistericheskoe-rasstroystvo-lichnosti%2F

Особое внимание уделяется возрастным изменениям и их связи с психическим здоровьем.

Также рассматриваются современные медикаментозные и немедикаментозные методы лечения.

Статьи помогут лучше понять, как справляться с угнетенным состоянием в пожилом возрасте.

I was just looking for this information for some time. After 6 hours of continuous Googleing, at last I got it in your site. I wonder what is the lack of Google strategy that do not rank this type of informative web sites in top of the list. Generally the top web sites are full of garbage.

Hi there, just became aware of your blog through Google, and found that it’s really informative. I’m going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

WONDERFUL Post.thanks for share..more wait .. …

Hi there! Would you mind if I share your blog with my zynga group? There’s a lot of people that I think would really enjoy your content. Please let me know. Thanks

I really appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a little bit, but other than that, this is great blog. A great read. I’ll certainly be back.

The digital drugstore provides a broad selection of health products with competitive pricing.

You can find all types of remedies to meet your health needs.

We work hard to offer high-quality products at a reasonable cost.

Speedy and secure shipping ensures that your medication gets to you quickly.

Take advantage of shopping online through our service.

https://www.adsoftheworld.com/users/ffadf9b3-a20b-4efb-aecb-289cf0b9e024

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research about this. We got a grab a book from our area library but I think I learned more clear from this post. I’m very glad to see such excellent info being shared freely out there.

The digital drugstore provides a broad selection of pharmaceuticals at affordable prices.

Shoppers will encounter various medicines for all health requirements.

We work hard to offer trusted brands while saving you money.

Quick and dependable delivery guarantees that your order gets to you quickly.

Enjoy the ease of getting your meds on our platform.

https://community.alteryx.com/t5/user/viewprofilepage/user-id/574146

На данной платформе вы найдете центр психологического здоровья, которая предлагает психологические услуги для людей, страдающих от стресса и других психических расстройств. Наша эффективные методы для восстановления ментального здоровья. Врачи нашего центра готовы помочь вам справиться с трудности и вернуться к психологическому благополучию. Квалификация наших психологов подтверждена множеством положительных рекомендаций. Обратитесь с нами уже сегодня, чтобы начать путь к восстановлению.

http://jdcleveland.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Ff%2Ffenibut%2F

This site is my intake, real wonderful layout and perfect articles.

Some really excellent info , Glad I discovered this. “The outer conditions of a person’s life will always be found to reflect their inner beliefs.” by James Allen.

Здесь вы найдете учреждение ментального здоровья, которая обеспечивает поддержку для людей, страдающих от тревоги и других ментальных расстройств. Эта эффективные методы для восстановления ментального здоровья. Наши специалисты готовы помочь вам преодолеть трудности и вернуться к сбалансированной жизни. Квалификация наших врачей подтверждена множеством положительных отзывов. Обратитесь с нами уже сегодня, чтобы начать путь к оздоровлению.

http://lifebeyonddivorce.net/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fm%2Fmelatonin%2F

Здесь вы найдете учреждение психологического здоровья, которая предоставляет поддержку для людей, страдающих от депрессии и других ментальных расстройств. Мы предлагаем комплексное лечение для восстановления психического здоровья. Наши специалисты готовы помочь вам справиться с психологические барьеры и вернуться к психологическому благополучию. Квалификация наших специалистов подтверждена множеством положительных отзывов. Обратитесь с нами уже сегодня, чтобы начать путь к лучшей жизни.

http://linedriveu.net/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fk%2Fkorvalol%2F

The design and usability are top-notch, making everything flow smoothly.

I love how user-friendly and intuitive everything feels.

A good book isn’t just entertainment—it’s a portal to another world. The best stories stay with you long after you’ve turned the last page.

GameAthlon is a renowned gaming site offering exciting gameplay for players of all backgrounds.

The site offers a extensive collection of slots, real-time games, table games, and sportsbook.

Players are offered seamless navigation, high-quality graphics, and easy-to-use interfaces on both PC and mobile devices.

http://www.gameathlon.gr

GameAthlon takes care of safe gaming by offering trusted payment methods and reliable outcomes.

Promotions and loyalty programs are constantly improved, giving registered users extra opportunities to win and have fun.

The support service is available around the clock, supporting with any questions quickly and professionally.

The site is the ideal choice for those looking for an adrenaline rush and big winnings in one safe space.

В грядущем сезоне наберут актуальность необычные цветовые сочетания, экологичные фактуры и уникальный силуэт.

Следует присмотреться ярких элементов и нестандартных рисунков.

Гуру стиля рекомендуют смело сочетать формами и не бояться современные тенденции в личный стиль.

Минимализм остаются в моде, однако их стоит дополнить яркими элементами.

Поэтому ключ к стилю нынешнего сезона — уверенность в себе и умелое переплетение классики с трендами.

https://sneakero.ru/

There are some fascinating cut-off dates in this article but I don’t know if I see all of them heart to heart. There may be some validity but I will take maintain opinion till I look into it further. Good article , thanks and we want more! Added to FeedBurner as effectively

Swiss watches have long been a gold standard in horology. Crafted by legendary artisans, they combine classic techniques with cutting-edge engineering.

All elements demonstrate unmatched quality, from intricate mechanisms to high-end finishes.

Investing in a timepiece is not just about telling time. It represents timeless elegance and uncompromising quality.

No matter if you love a classic design, Swiss watches deliver unparalleled precision that never goes out of style.

http://lchv.net/lchvboard/viewtopic.php?f=1&t=12711

We offer a wide range of certified medicines for different conditions.

Our platform guarantees speedy and secure order processing wherever you are.

All products is supplied by certified pharmaceutical companies to ensure effectiveness and reliability.

Easily search through our catalog and place your order in minutes.

Need help? Pharmacy experts are here to help 24/7.

Take care of yourself with affordable e-pharmacy!

https://www.storeboard.com/blogs/health/fildena-side-effects-an-honest-exploration-of-what-to-expect/6074893

Что такое BlackSprut?

BlackSprut вызывает обсуждения разных сообществ. Что делает его уникальным?

Эта площадка предлагает интересные возможности для своих пользователей. Оформление платформы характеризуется удобством, что делает платформу понятной даже для тех, кто впервые сталкивается с подобными сервисами.

Необходимо помнить, что этот ресурс имеет свои особенности, которые делают его особенным в определенной среде.

При рассмотрении BlackSprut важно учитывать, что многие пользователи выражают неоднозначные взгляды. Многие подчеркивают его функциональность, а кто-то оценивают его более критично.

В целом, данный сервис остается темой дискуссий и привлекает заинтересованность разных пользователей.

Свежий сайт BlackSprut – здесь можно найти

Если нужен обновленный сайт БлэкСпрут, вы на верном пути.

https://bs2best

Сайт часто обновляет адреса, поэтому важно иметь обновленный линк.

Мы мониторим за актуальными доменами чтобы предоставить актуальным зеркалом.

Посмотрите рабочую ссылку у нас!

so much superb information on here, : D.

Чем интересен BlackSprut?

Сервис BlackSprut вызывает интерес разных сообществ. В чем его особенности?

Этот проект предоставляет широкие функции для аудитории. Интерфейс сайта отличается функциональностью, что делает его доступной даже для тех, кто впервые сталкивается с подобными сервисами.

Стоит учитывать, что данная система имеет свои особенности, которые формируют его имидж в определенной среде.

Говоря о BlackSprut, стоит отметить, что различные сообщества имеют разные мнения о нем. Одни подчеркивают его функциональность, а кто-то рассматривают более критично.

Таким образом, данный сервис остается объектом интереса и удерживает заинтересованность разных пользователей.

Где найти актуальный линк на BlackSprut?

Если ищете обновленный сайт BlackSprut, вы на верном пути.

bs2best at

Иногда ресурс перемещается, и тогда нужно знать новое ссылку.

Обновленный доступ легко найти здесь.

Проверьте актуальную версию сайта прямо сейчас!

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

This website offers a large variety of slot games, designed for different gaming styles.

On this site, you can discover retro-style games, new generation slots, and progressive jackpots with amazing animations and dynamic music.

No matter if you’re into simple gameplay or prefer bonus-rich rounds, you’re sure to find a perfect match.

http://www.1bm.ru/forum/viewtopic.php?p=529938#529938

Every slot is playable around the clock, with no installation, and perfectly tuned for both desktop and smartphone.

Apart from the machines, the site features tips and tricks, bonuses, and user ratings to enhance your experience.

Join now, spin the reels, and get immersed in the world of digital reels!

На этом сайте вы можете играть в большим выбором слотов.

Слоты обладают красочной графикой и интерактивным игровым процессом.

Каждый слот предлагает особые бонусные возможности, увеличивающие шансы на выигрыш.

1xbet вход на сегодня

Игра в слоты подходит как новичков, так и опытных игроков.

Можно опробовать игру без ставки, после чего начать играть на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

Medical grade honey heals stubborn wounds. The iMedix podcast examines this ancient remedy’s modern revival. Burn specialists share remarkable case studies. Sometimes the best solutions are rediscoveries—hear more from iMedix: Your Personal Health Advisor!

Thanks, I have just been looking for info approximately this subject for a while and yours is the best I’ve came upon till now. But, what concerning the conclusion? Are you sure about the supply?

Suicide is a complex phenomenon that affects millions of people worldwide.

It is often associated with mental health issues, such as bipolar disorder, hopelessness, or addiction problems.

People who contemplate suicide may feel overwhelmed and believe there’s no hope left.

how-to-kill-yourself.com

We must raise awareness about this topic and offer a helping hand.

Early support can save lives, and talking to someone is a crucial first step.

If you or someone you know is struggling, please seek help.

You are not alone, and help is available.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

На этом сайте вы можете играть в широким ассортиментом игровых слотов.

Игровые автоматы характеризуются красочной графикой и интерактивным игровым процессом.

Каждая игра даёт индивидуальные бонусные функции, повышающие вероятность победы.

1xbet казино

Слоты созданы для любителей азартных игр всех мастей.

Есть возможность воспользоваться демо-режимом, а затем перейти к игре на реальные деньги.

Испытайте удачу и насладитесь неповторимой атмосферой игровых автоматов.

На нашем портале вам предоставляется возможность испытать широким ассортиментом игровых автоматов.

Игровые автоматы характеризуются красочной графикой и увлекательным игровым процессом.

Каждая игра даёт уникальные бонусные раунды, повышающие вероятность победы.

Mostbet betting

Слоты созданы для как новичков, так и опытных игроков.

Можно опробовать игру без ставки, и потом испытать азарт игры на реальные ставки.

Испытайте удачу и насладитесь неповторимой атмосферой игровых автоматов.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

WONDERFUL Post.thanks for share..extra wait .. …

This is really interesting, You are a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Hello there, simply turned into alert to your weblog through Google, and found that it’s really informative. I’m gonna be careful for brussels. I’ll be grateful when you proceed this in future. Numerous other people can be benefited out of your writing. Cheers!

Hmm it appears like your website ate my first comment (it was extremely long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to the whole thing. Do you have any tips for novice blog writers? I’d really appreciate it.

A powerful share, I simply given this onto a colleague who was doing a bit analysis on this. And he in actual fact bought me breakfast as a result of I discovered it for him.. smile. So let me reword that: Thnx for the deal with! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love studying more on this topic. If attainable, as you turn into expertise, would you mind updating your blog with more particulars? It’s extremely useful for me. Large thumb up for this blog submit!

hello there and thank you in your info – I’ve certainly picked up anything new from proper here. I did on the other hand expertise a few technical points the usage of this web site, as I skilled to reload the website a lot of times prior to I could get it to load correctly. I had been wondering if your hosting is OK? Not that I’m complaining, however sluggish loading instances occasions will very frequently impact your placement in google and can injury your high quality ranking if ads and ***********|advertising|advertising|advertising and *********** with Adwords. Anyway I’m including this RSS to my e-mail and could glance out for a lot more of your respective intriguing content. Make sure you update this once more soon..

Howdy! I know this is kinda off topic but I was wondering which blog platform are you using for this site? I’m getting tired of WordPress because I’ve had problems with hackers and I’m looking at alternatives for another platform. I would be fantastic if you could point me in the direction of a good platform.

I?¦m now not certain the place you are getting your information, however good topic. I must spend a while finding out more or figuring out more. Thanks for wonderful info I was looking for this information for my mission.

Hey! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing several weeks of hard work due to no backup. Do you have any methods to protect against hackers?

Платформа BlackSprut — это одна из самых известных точек входа в теневом интернете, открывающая разнообразные сервисы для всех, кто интересуется сетью.

Здесь доступна простая структура, а интерфейс не вызывает затруднений.

Участники отмечают отзывчивость платформы и постоянные обновления.

bs2best.markets

Сервис настроен на комфорт и минимум лишней информации при использовании.

Кому интересны альтернативные цифровые пространства, площадка будет удобной точкой старта.

Прежде чем начать лучше ознакомиться с основы сетевой безопасности.

Защищенность соединения при работе с секретными данными должна быть приоритетом для любой компании. Раскрытие информации может привести к существенным последствиям и финансовым потерям. Использование систем [url=https://graph.org/Kak-vybrat-optimalnyye-nastroyki-proksi-03-31 ]прокси мобильные бесплатно [/url] значительно уменьшает подобные риски, обеспечивая дополнительный барьер защиты. Подлинные IP-адреса мобильных операторов позволяют создать прочный барьер между пользователем и потенциальными рисками в интернет-пространстве.

Источник: [url=https://netgate.kiev.ua/internet/15821-vliyaet-li-mobilnyj-operator-na-kachestvo-proksi/ ]бесплатные прокси мобильные [/url]

Смело попросить меня за помощью по вопросам Топ мобильных прокси – обращайтесь в Telegram imz10

Онлайн-площадка — интернет-представительство независимого расследовательской службы.

Мы предоставляем поддержку в области розыска.

Команда опытных специалистов работает с максимальной этичностью.

Мы берёмся за поиски людей и выявление рисков.

Детективное агентство

Каждое обращение рассматривается индивидуально.

Мы используем эффективные инструменты и действуем в правовом поле.

Нуждаетесь в реальную помощь — добро пожаловать.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

This website offers a large assortment of home timepieces for any space.

You can discover minimalist and classic styles to match your home.

Each piece is chosen for its aesthetic value and functionality.

Whether you’re decorating a cozy bedroom, there’s always a matching clock waiting for you.

automatic set radio alarm clocks

Our catalog is regularly expanded with new arrivals.

We care about customer satisfaction, so your order is always in safe hands.

Start your journey to timeless elegance with just a few clicks.

Here offers a wide selection of stylish timepieces for all styles.

You can discover contemporary and vintage styles to complement your apartment.

Each piece is carefully selected for its design quality and reliable performance.

Whether you’re decorating a functional kitchen, there’s always a matching clock waiting for you.

geneva 4625g digital wall clocks

Our assortment is regularly expanded with fresh designs.

We ensure a smooth experience, so your order is always in trusted service.

Start your journey to better decor with just a few clicks.

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.

The Triumvirate’s downfall took place when Meetra Surik, a Jedi who was exiled after the Mandalorian Wars, returned to recognized area.

I really like your writing style, good info , thankyou for putting up : D.

Данный ресурс создан для поиска занятости в Украине.

Здесь вы найдете множество позиций от разных организаций.

Мы публикуем вакансии в разнообразных нишах.

Подработка — всё зависит от вас.

Кримінальна робота

Поиск удобен и рассчитан на новичков и специалистов.

Создание профиля не потребует усилий.

Нужна подработка? — заходите и выбирайте.

Этот сайт предлагает интересные новостные материалы на любые темы.

Здесь вы легко найдёте аналитика, технологиях и разнообразных темах.

Информация обновляется в режиме реального времени, что позволяет не пропустить важное.

Удобная структура облегчает восприятие.

https://femalemoda.ru

Каждое сообщение написаны грамотно.

Мы стремимся к достоверности.

Присоединяйтесь к читателям, чтобы быть на волне новостей.

I have learn a few just right stuff here. Definitely worth bookmarking for revisiting. I wonder how much effort you put to create one of these fantastic informative site.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

Новый летний период обещает быть насыщенным и экспериментальным в плане моды.

В тренде будут асимметрия и неожиданные сочетания.

Цветовая палитра включают в себя чистые базовые цвета, выделяющие образ.

Особое внимание дизайнеры уделяют аксессуарам, среди которых популярны макросумки.

https://truckymods.io/user/292102

Возвращаются в моду элементы модерна, в свежем прочтении.

В новых коллекциях уже можно увидеть захватывающие образы, которые вдохновляют.

Не упустите шанс, чтобы встретить лето стильно.

Here, you can discover lots of online slots from famous studios.

Visitors can experience retro-style games as well as new-generation slots with high-quality visuals and interactive gameplay.

Even if you’re new or an experienced player, there’s something for everyone.

slot casino

The games are ready to play round the clock and designed for desktop computers and tablets alike.

All games run in your browser, so you can start playing instantly.

Site navigation is intuitive, making it quick to find your favorite slot.

Register now, and dive into the world of online slots!

Thank you for every one of your labor on this web page. My mom take interest in participating in internet research and it is simple to grasp why. We all know all concerning the lively form you render rewarding solutions by means of the web blog and in addition increase contribution from others on the idea while our own daughter is becoming educated a great deal. Take advantage of the remaining portion of the new year. You’re the one doing a stunning job.

The digital drugstore offers a wide range of medications with competitive pricing.

Customers can discover all types of remedies suitable for different health conditions.

We work hard to offer high-quality products at a reasonable cost.

Quick and dependable delivery ensures that your medication is delivered promptly.

Take advantage of getting your meds on our platform.

sildalis 120 mg

Here, you can access a wide selection of online slots from leading developers.

Users can experience retro-style games as well as feature-packed games with stunning graphics and bonus rounds.

If you’re just starting out or a seasoned gamer, there’s something for everyone.

play aviator

The games are instantly accessible anytime and optimized for laptops and smartphones alike.

No download is required, so you can start playing instantly.

Platform layout is intuitive, making it quick to explore new games.

Sign up today, and dive into the thrill of casino games!

Thanks for this fantastic post, I am glad I found this site on yahoo.

LIPOZEM REVIEW

LIPOZEM REVIEW

Hiya! I know this is kinda off topic nevertheless I’d figured I’d ask. Would you be interested in exchanging links or maybe guest authoring a blog post or vice-versa? My blog goes over a lot of the same topics as yours and I believe we could greatly benefit from each other. If you might be interested feel free to shoot me an e-mail. I look forward to hearing from you! Great blog by the way!

Наличие страхового полиса при выезде за границу — это разумное решение для финансовой защиты путешественника.

Страховка покрывает неотложную помощь в случае несчастного случая за границей.

Помимо этого, сертификат может включать покрытие расходов на репатриацию.

icforce.ru

Определённые государства предусматривают наличие страховки для въезда.

Без страховки медицинские расходы могут быть финансово обременительными.

Оформление полиса заблаговременно

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

Предстоящее лето обещает быть насыщенным и инновационным в плане моды.

В тренде будут свободные силуэты и яркие акценты.

Актуальные тона включают в себя неоновые оттенки, выделяющие образ.

Особое внимание дизайнеры уделяют аксессуарам, среди которых популярны винтажные очки.

https://www.liveinternet.ru/users/lepodium/post509880933/

Снова популярны элементы 90-х, через призму сегодняшнего дня.

На улицах мегаполисов уже можно увидеть трендовые образы, которые вдохновляют.

Будьте в курсе, чтобы встретить лето стильно.

Traditional timepieces will continue to be fashionable.

They embody craftsmanship and provide a human touch that tech-based options simply cannot match.

Every model is powered by precision mechanics, making it both useful and artistic.

Watch enthusiasts cherish the craft behind them.

https://www.ganjingworld.com/ru-RU/post/1gvd2rjs0c35HV4me2s1EUZg017i1c

Wearing a mechanical watch is not just about telling time, but about making a statement.

Their designs are everlasting, often passed from father to son.

To sum up, mechanical watches will remain icons.

This platform offers you the chance to get in touch with professionals for one-time risky missions.

Users can quickly request assistance for specialized requirements.

All listed individuals are trained in managing critical tasks.

hire an assassin

This site ensures safe connections between employers and workers.

Whether you need fast support, this platform is the perfect place.

Submit a task and match with a professional instantly!

В этом разделе вы можете получить действующее зеркало 1хбет без блокировок.

Мы регулярно обновляем доступы, чтобы облегчить непрерывный вход к порталу.

Открывая резервную копию, вы сможете пользоваться всеми функциями без перебоев.

1хбет зеркало

Эта страница поможет вам моментально перейти на актуальный адрес 1хбет.

Мы следим за тем, чтобы любой игрок был в состоянии не испытывать проблем.

Следите за актуальной информацией, чтобы быть на связи с 1хБет!

Данный ресурс — подтверждённый онлайн-площадка Bottega Венета с отгрузкой по всей России.

Через наш портал вы можете приобрести оригинальные товары Боттега Венета без посредников.

Любая покупка имеют гарантию качества от марки.

bottega veneta italy

Доставление осуществляется в кратчайшие сроки в любой регион России.

Интернет-магазин предлагает безопасные способы оплаты и комфортные условия возврата.

Покупайте на официальном сайте Bottega Veneta, чтобы наслаждаться оригинальными товарами!

在这个网站上,您可以雇佣专门从事一次性的高风险任务的执行者。

我们提供大量技能娴熟的行动专家供您选择。

无论需要何种危险需求,您都可以轻松找到合适的人选。

为了钱而下令谋杀

所有合作人员均经过审核,确保您的隐私。

任务平台注重匿名性,让您的个别项目更加安心。

如果您需要具体流程,请随时咨询!