Limit your Losses with Vertical Spreads

Options vertical spreads are options trading strategies that involve simultaneously buying and selling options of the same underlying asset, and the same expiration date, but with different strike prices. They are called “vertical” spreads because the different strike prices create a vertical distance on the options chain.

Vertical spreads can be opened with Calls or with Puts, and they can be opened as a credit or a debit. There are two types of vertical spreads, Bullish and Bearish,

Bullish Spreads

Bull Call Spread

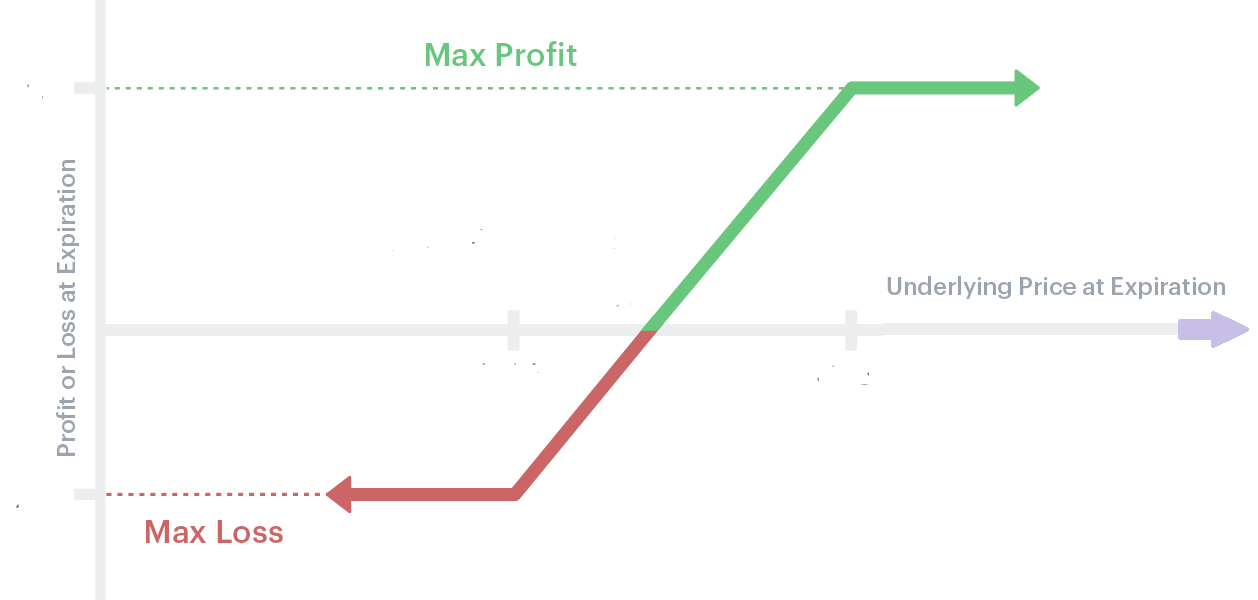

In a Bull call spread, an investor buys a call option with a lower strike price and simultaneously sells a call option with a higher strike price. This strategy is used when the investor expects the price of the underlying asset to rise.

The premium received from selling the higher strike call partially offsets the premium paid for buying the lower strike call, reducing the overall cost of the position. Because there is a net premium paid up front, this is considered a debit position. The net premium represents the total risk of the position.

Your profit on a Bull Call Spread is maximized when the stock price rises above the higher strike price on or before expiration.

Bull Put Spread

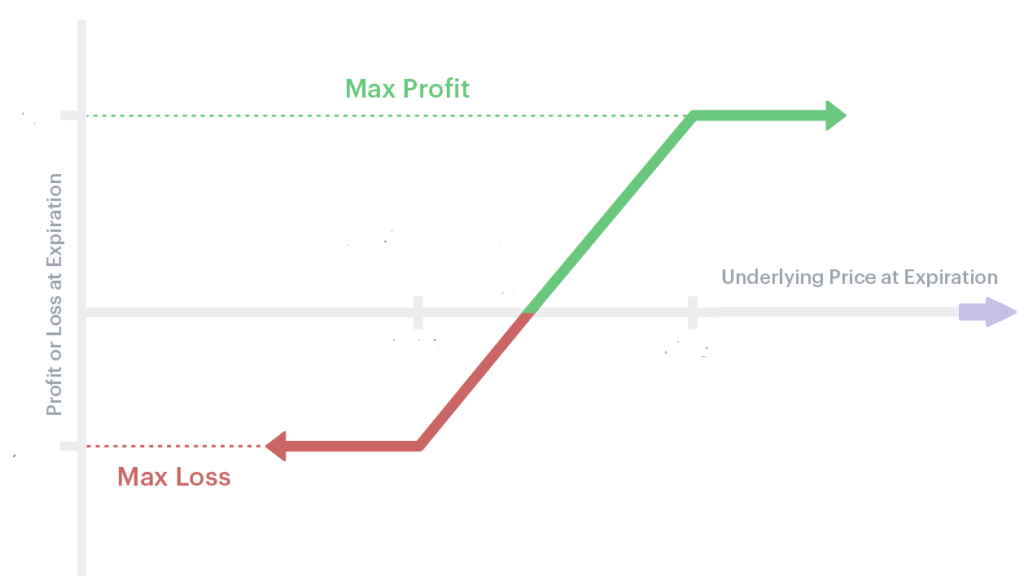

In a Bull put spread, an investor sells a put option with a higher strike price and simultaneously buys a put option with a lower strike price. This strategy is used when the investor expects the price of the underlying asset to remain above the higher strike price.

The premium received from selling the higher strike put more than offsets the premium paid for buying the lower strike put, providing a net credit at open. This credit represents the maximum profit that can be earned from the position.

The maximum risk for this position is the difference in strike prices times 100, minus the premium difference in the two options. Your maximum risk is only realized if the stock price falls below the lower strike price on or before expiration.

Bearish Spreads

Bear Call Spread

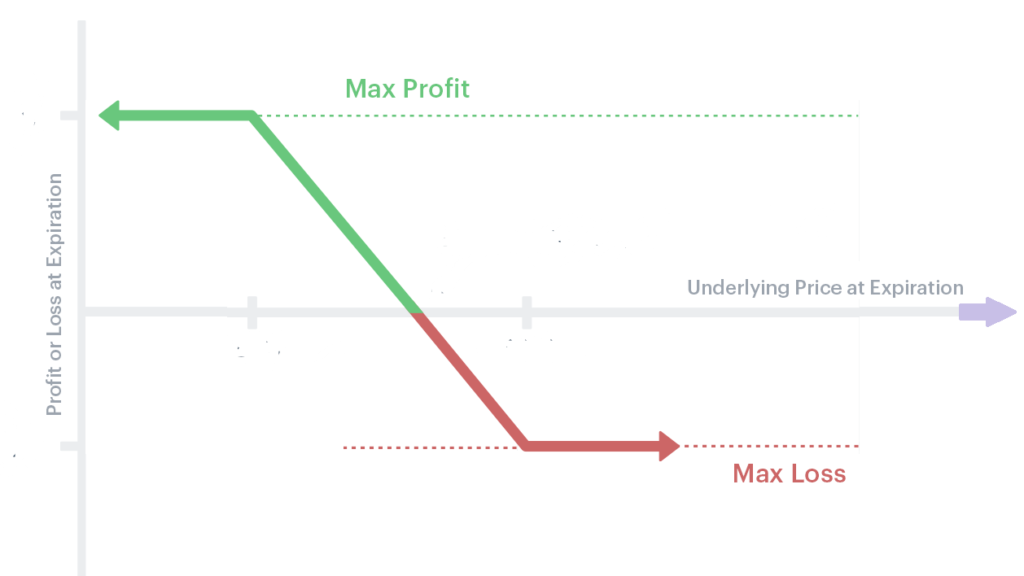

In a bear call spread, an investor sells a call option with a lower strike price and simultaneously buys a call option with a higher strike price. This strategy is used when the investor expects the price of the underlying asset to be below the lower strike price on or before expiration.

As to be expected, this is opened as a credit. just like the Bull Put spread. Your maximum profit and loss is calculated in a similar fashion as well.

Bear Put Spread

In a Bear Put spread, an investor buys a put option with a higher strike price and simultaneously sells a put option with a lower strike price. This strategy is used when the investor expects the price of the underlying asset to be below the lower strike price on or before expiration.

The premium received from selling the lower strike put helps offset the premium paid for buying the higher strike put, reducing the overall cost of the position.This is opened as a debit, and has similar characteristics as a Bull Call Spread for calculating your maximum profit and loss.

Limit your Losses (and your profits)

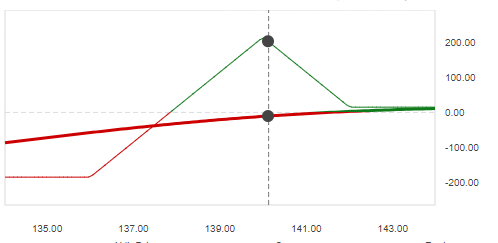

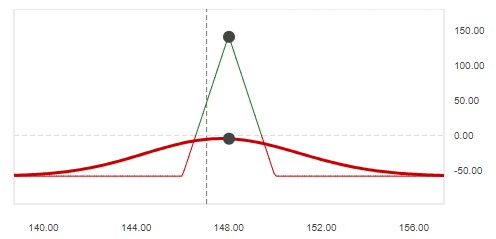

Vertical spreads limit potential losses, at the cost of also limiting potential profits. The maximum profit is achieved if the price of the underlying asset is below the lower strike price at expiration for a Bear Spread, or above the higher strike price for a Bull Spread.

The maximum loss is limited to the difference in strike prices minus the premium received or paid. That’s it.

When to use vertical spreads

Vertical spreads should be used when you have confidence in the direction a stock is going to take, but want to limit your risk. They’re also easy to set up for success with only moderate stock movement, unlike a Strangles or Straddles.

As with all options trading, you should know your risk tolerance and market expectations before implementing these strategies.

Thanks a bunch for sharing this with all people you really know what you’re talking about! Bookmarked. Please additionally consult with my web site =). We will have a link exchange agreement between us!

Great line up. We will be linking to this great article on our site. Keep up the good writing.

I was studying some of your content on this website and I believe this site is really instructive! Retain putting up.

I’m curious to find out what blog platform you’re working with? I’m experiencing some minor security problems with my latest site and I would like to find something more safeguarded. Do you have any suggestions?

Somebody essentially help to make seriously articles I would state. This is the first time I frequented your web page and thus far? I amazed with the research you made to create this particular publish amazing. Magnificent job!