Why Buying OTM Call Options is a Bad Idea

If you’re new to options trading, read this first

When most investors learn about options trading for the first time, they tend to have the same first impulse – they want to buy call options. Most of the time, that impulse is wrong.

It’s understandable. The leverage aspect of long call options means that you get to participate in the upside profit when a stock goes up, and that your risk is limited if the stock declines instead.

Due to their low cost, out of the money (OTM) call options especially seem like a good place to start for new options traders. Buy a cheap call option and see if you can pick a winner. If you’re about to start trading with a relatively small amount of capital, you may think of OTM calls as a way to make big profits quickly.

This may feel safe, but they are actually one of the hardest ways to make money in options trading. If you limit yourself to only this strategy, you are likely to lose money more often than you make a profit.

As of today, Facebook stock (META) is sitting at $165. If you look at CALL options that are 30 days out, the options at a $195 strike price are only $0.99. The stock traded at or above that strike price for most of the first six months of this year, and most one-year price targets for that stock are way above that price.

So let’s say you buy 10 out of far out-of-the-money calls at $0.99/ea for $1,000 total (10 * $0.99 * 100. Because they’re so cheap, you can buy a lot of them. And now you control 1,000 shares of stock.

If the shares rise rapidly, and you hold on to this option all the way until expiration, you only need the price to rise to $196 before you can turn a profit on it. If the price rises to $205, which it’s exceeded many times this year, you could make a $9,000 profit on this (10 x ($205 stock price – $195 option price – $0.99 option cost)). The higher the stock price at expiration, the more profit you can make.

But what if the stock closes at $195? Anything less than $195.99 is a loss, because you spent $0.99 per share on the option. If you hold on to that stock until expiration, and it never gets to $196, it will not be profitable. Anything between $195 and $195.99 might allow you to recoup some of your cost, but anything less than $195 is a total loss.

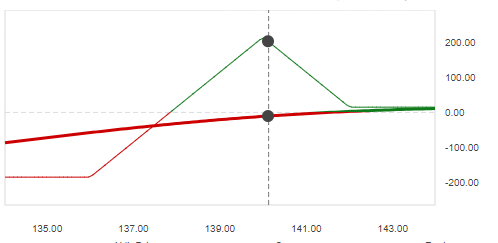

Here is the profit/loss chart for this option:

See how this is a money losing trade until the price gets to $195, then the loss reduces until you break even at $196. Anything above $196 is profit, with unlimited upside.

So you’re probably looking at this, and thinking it doesn’t actually look too bad.

You’re 30 days out from expiration, and that’s plenty of time for a stock to go up less than 20% from $165 to $195. But it’s also plenty of time for a lot of bad things to happen. One piece of major bad news, and you might not see this stock get that high for six months or a year. You know how life goes, this isn’t all that unlikely of a situation.

If you only had $10,000 in your account to start with, now you only have $9,000. It doesn’t take too many of these types of trades to fail before you’ve run out of money.

There are occasionally opportunities to make OTM call purchases where the odds of being profitable are significantly in your favor. They don’t happen very often, but they’re sweet when they do.

But if your strategy is to buy the cheapest available call in the hopes that a wild rally will turn you into an instant paper millionaire, there’s a good chance you’re flushing that money down the toilet