Why Options Trading

I’m going to make a million dollars in income a year.

Sounds great. But seriously, how can an average person just build a million dollar income?

There’s actually many pathways to follow to do this, but most don’t suit me. I make good money in my line of work, but it’s not going to get me a million dollar salary. I’m too old to change careers. Real estate takes too much capital, and time, to build quickly (I’ll talk more about this later).

I could start or build a business. But that would probably take my attention away from my job. My number one rule in this is that I can’t do anything that impacts my work. So without hiring someone to run the business for me, which introduces a lot more risk, and eats at my earnings, this just isn’t a feasible pathway for me.

In order to build a million dollar income stream, it has to be something that doesn’t require me to switch careers. Something I can start with not a lot of cash. And something that doesn’t negatively impact my job.

The pathway I landed on is options trading.

I’ve had an etrade account for years, mostly just buying or selling a stock or two, but never really growing the account. It wasn’t that I didn’t want to, I just never viewed stock trading as a serious investment vehicle for myself. But I was looking for something I could invest in and grow.

I had some rental real estate before, but had mixed success with it. As I grew in my career, I had less and less time for it, and had exited most of my investments by the time I relocated my family to Florida in 2015 for my work.

My job and family stuff kept me pretty busy for awhile, but by 2017 I was thinking hard about investing again. I looked at all kinds of opportunities, but just never really found something that I thought would make sense for me. Time dragged on, before I finally started to get into real estate again.

I started first with investing in REIT’s. It didn’t take any effort, and I was able to get into some funds that were making as high as an 8% regular return. But this didn’t really satisfy me, so in 2019 I got into physical real estate again.

I ended up with an AirBNB property in a desirable area of Tampa. It was expensive, and high maintenance, but was spinning off a good amount of cash. At least for awhile. Wear and tear on the property was high, so there were always minor expenses and repairs. Even with this, the returns were good, but it was eating up a lot of my time. I knew for this to be sustainable I needed to build a business around it. Which meant more properties, and hiring management. I started to put together a plan, and rounded up some fellow investors to partner with. By the end of 2019 things were coming together. We were set to acquire

another 2-3 properties in 2020, and in the process start to have the right management in place so that I wasn’t so involved in the day to day.

Then the pandemic hit.

One after another, the blocks started to fall. Earnings from the property went negative in a big way. And the pool of investors I had put together started to fall apart. The plan I had put together just didn’t make sense anymore, at least not during a pandemic.

Luckily, neither my wife’s job nor mine was affected by this. But I was stuck at home, not making money from my physical real estate (interestingly, my REIT funds still did well during all this). I wanted to get into something, but I was back at square one.

I discovered options trading.

It was actually kind of accidental. But I was on the phone with my parents, checking on their sanity while being locked up at home, when my Dad started talking about options. He’s retired, and I knew he was doing options trading for awhile, but I never paid any attention to it. I always thought of it as super high risk, and requiring way more capital than I had on hand. But this time he caught my intererest with it.

I started to read up on it, and requested options trading on my etrade account. It was approved right away, so I started to pull this thread.

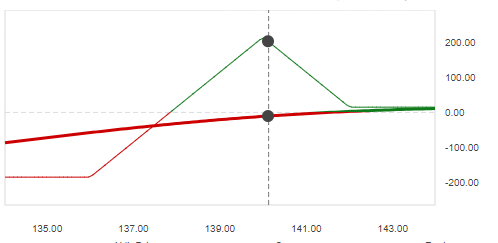

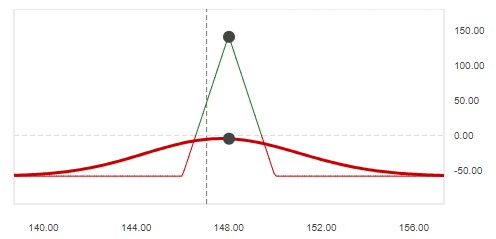

I took it really slow at first. In late summer of 2020, I picked a relatively inexpensive stock- AMD, which was trading in the $80-90 range at the time. I’d sell a covered CALL here, or a PUT there, and pretty soon I was making a couple hundred a week. I’d reinvest the returns each week, and eventually I started trading options on a second stock. I was earning $500 a week on average by the end of february in 2021.

Then I started a new job. I lost focus on my trading, and my returns started to decline. In order to compensate, I started making riskier trades, and trading in a wider basked of stocks. I wasn’t disciplined in this, and by the end of the year I was losing money pretty rapidly.

It didn’t help that volatility increased throughout the year. I found myself on the wrong end of Bear CALL and Bull PUT trades frequently. I just wasn’t paying close enough attention, and was taking too much risk with each trade.

After the holidays, and rolling into 2022, I went back to the basics that I had sucess with early on. It took awhile to unwind some of of the bad trades I still had sitting out there, but by March I was generating consistent positive returns again. Volatility hasn’t decreased- Russia invaded Ukraine, inflation is still running hot, the Fed is looking at increasing rates, but I’m taking a conservative approach that’s greatly reduced my risk to all this.

I’ll share more detail on what kinds of trades I’m doing later, but I’m essentially earning over a 100% annualized return on my cash right now. Every week, as my options expire, or execute, I reinvest the earnings. And the following week I make new trades, or sell stock that I’ve had to purchase from previous trades.

I’m also adding $100 a week to my account. So every week, I have a slightly higher purcashing power.

Right now, I’m generating a $20k a year income stream. If I’m able to maintain this consistency, earning positive returns, and adding to my account, I can grow this to be a million dollar income stream. I just need to stay disciplined, keep my risk level low, and stay the course.

So that’s why I’m using options trading as my means for reaching this goal.

With havin so much content and articles do you ever run into any issues of plagorism or copyright infringement? My website has a lot of unique content I’ve either created myself or outsourced but it seems a lot of it is popping it up all over the web without my authorization. Do you know any methods to help protect against content from being stolen? I’d really appreciate it.